KSE: The EU €90bn loan for Ukraine on December 19 improves Ukraine’s medium-term outlook

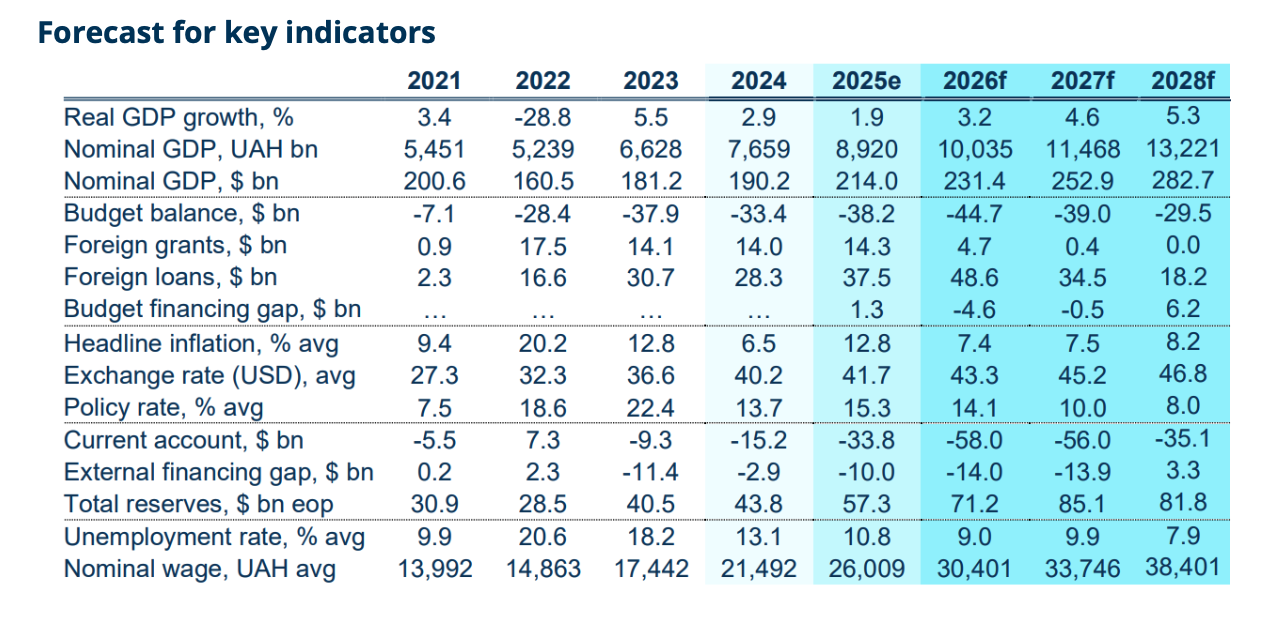

Ukraine’s macroeconomic outlook for this year has significantly improved due to a sharp increase in external financial support thanks to the €90bn EU loan promise in December, even as the war with Russia continues, according to the first quarter 2026 edition of the Ukraine Macroeconomic Handbook published by the Kyiv School of Economics (KSE) Institute.

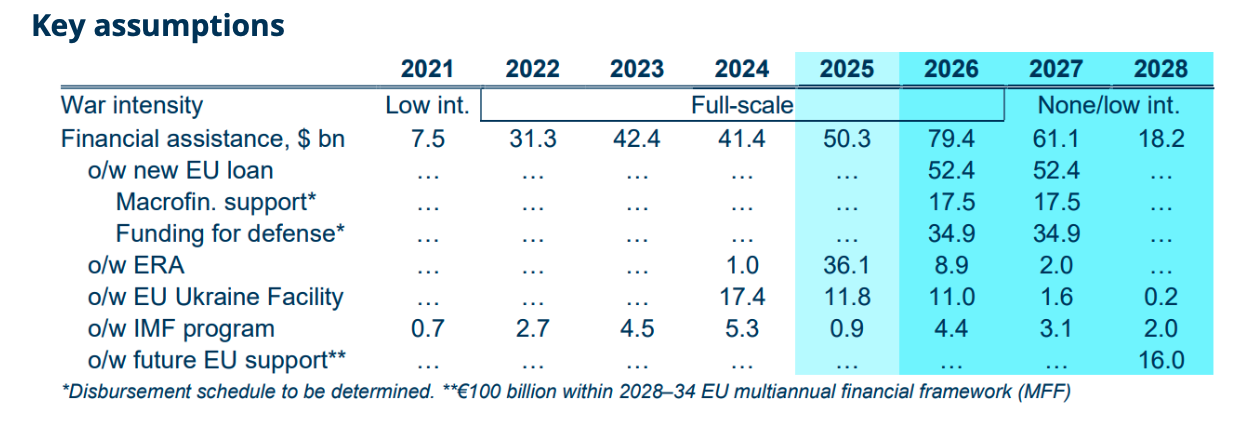

“The forecast now incorporates nearly $160bn in expected external grants and loans over 2026–28,” KSE Institute said. “This materially alters the balance of macroeconomic risks and ensures the financing of the state budget through 2028, despite exceptionally high wartime needs.”

The updated outlook is based on a central assumption that the war will end by late 2026. Among the key new funding streams is the EU’s €90bn loan package, an anticipated new programme from the International Monetary Fund, and resources earmarked in the EU’s next Multiannual Financial Framework. This support helps to close the $65bn fiscal financing gap previously identified by the IMF for 2026–29.

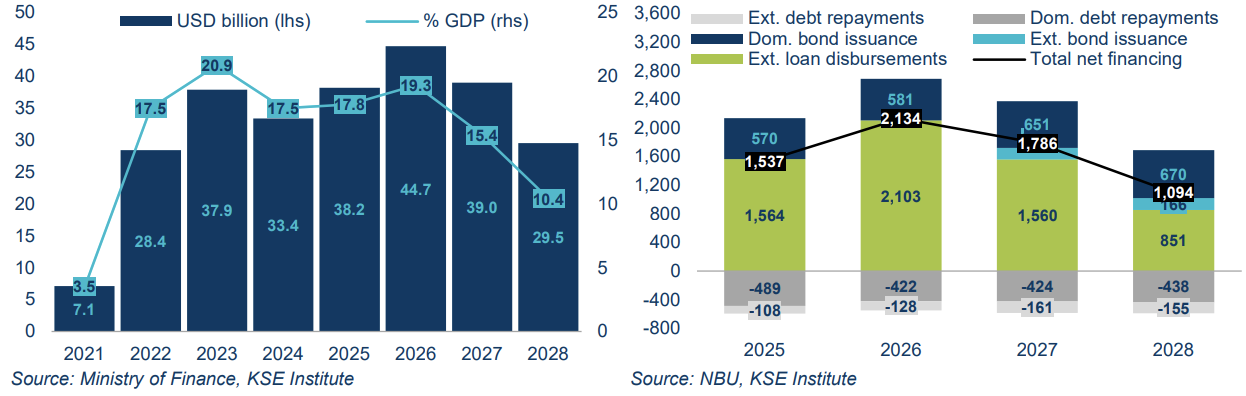

KSE estimates that the cumulative general government deficit over 2026–28 will reach $113.2bn, largely due to persistently high defence and security spending, which is expected to peak at $103bn in 2026. In 2025, the government spent 43% of GDP on defence alone. Confirmed and likely budget financing sources amount to $112.2bn, covering nearly all projected needs.

“New foreign funding, including €30bn in macro-financial assistance and a portion of the EU’s €60bn defence-industrial fund, is critical to fiscal stability,” KSE noted.

Despite a sharp deterioration in the trade balance — with the trade deficit widening by 54.6% year-on-year in 2025 to an estimated $49bn — KSE expects partner inflows to more than offset external financing requirements. These flows will also support the gradual accumulation of international reserves, forecast to reach $82bn by end-2028. “This is a markedly more favourable outcome than in previous projections,” KSE said.

Growth in 2025 is projected at 1.9%, constrained by renewed Russian attacks on Ukraine’s energy system during this winter’s big freeze, which weighed on production and consumption. The intensity of the attacks in January have led to a partial shut down of the Ukrainian economy, but a temporary ceasefire announced on January 29 by Trump may alleviate some of that pressure.

“The most acute downside risk remains energy infrastructure: if attacks intensify or firms cannot adapt, GDP losses could reach 2–3%,” KSE warned. That said, with the new EU support factored in, growth in 2026 is now forecast at 3.2%, rising to 5% annually in the post-war period as investment and reconstruction drive the recovery.

Public debt stood at $197.4bn in November 2025 and is expected to remain elevated in nominal terms. However, KSE believes international support mechanisms will ensure debt sustainability. “Excluding conditional obligations tied to potential Russian reparations, the debt-to-GDP ratio is projected to stabilise around 81% in 2026, before declining to approximately 77% by 2028.”

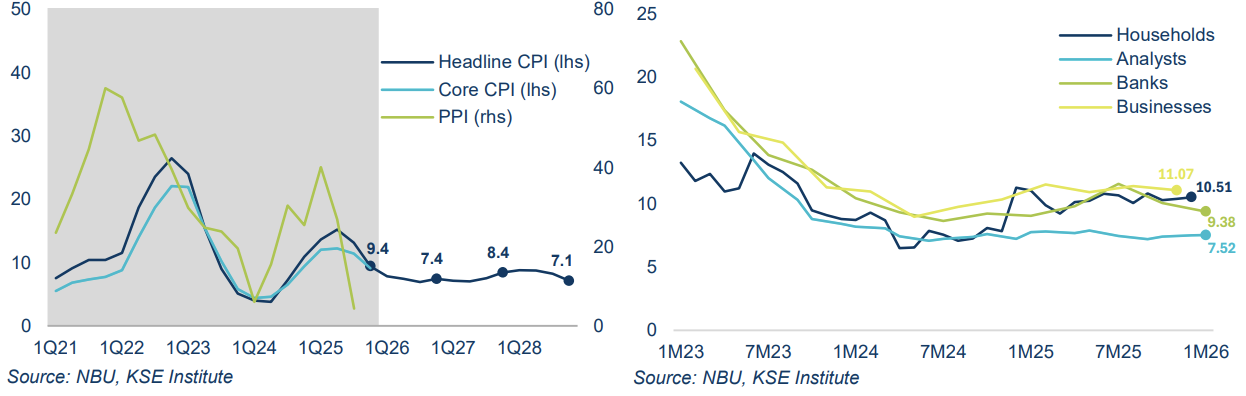

Inflation, which peaked at 15.9% in May 2025, eased to 8.0% by year-end, supported by tight monetary policy, stable exchange rates, and supply-side improvements. Inflation is projected to decline further to 7.4% in 2026, before a moderate increase in 2027 as reconstruction accelerates. The hryvnia is expected to weaken gradually to UAH44 per by end-2026.

“The macroeconomic outlook has become more balanced,” KSE Institute concluded. “While near-term risks remain, especially due to the war, Ukraine’s medium-term position is now underpinned by a robust and diversified financial support architecture.”

The Kyiv School of Economics (KSE) is a bne IntelliNews media partner and a leading source of economic analysis and information on Ukraine. This content originally appeared on the KSE website. Read the full Ukraine Macroeconomic Handbook (the first quarter 2026) here.

Unlock premium news, Start your free trial today.