KSE: Ukraine’s wartime spending hits record $131bn as defence absorbs 71% of budget

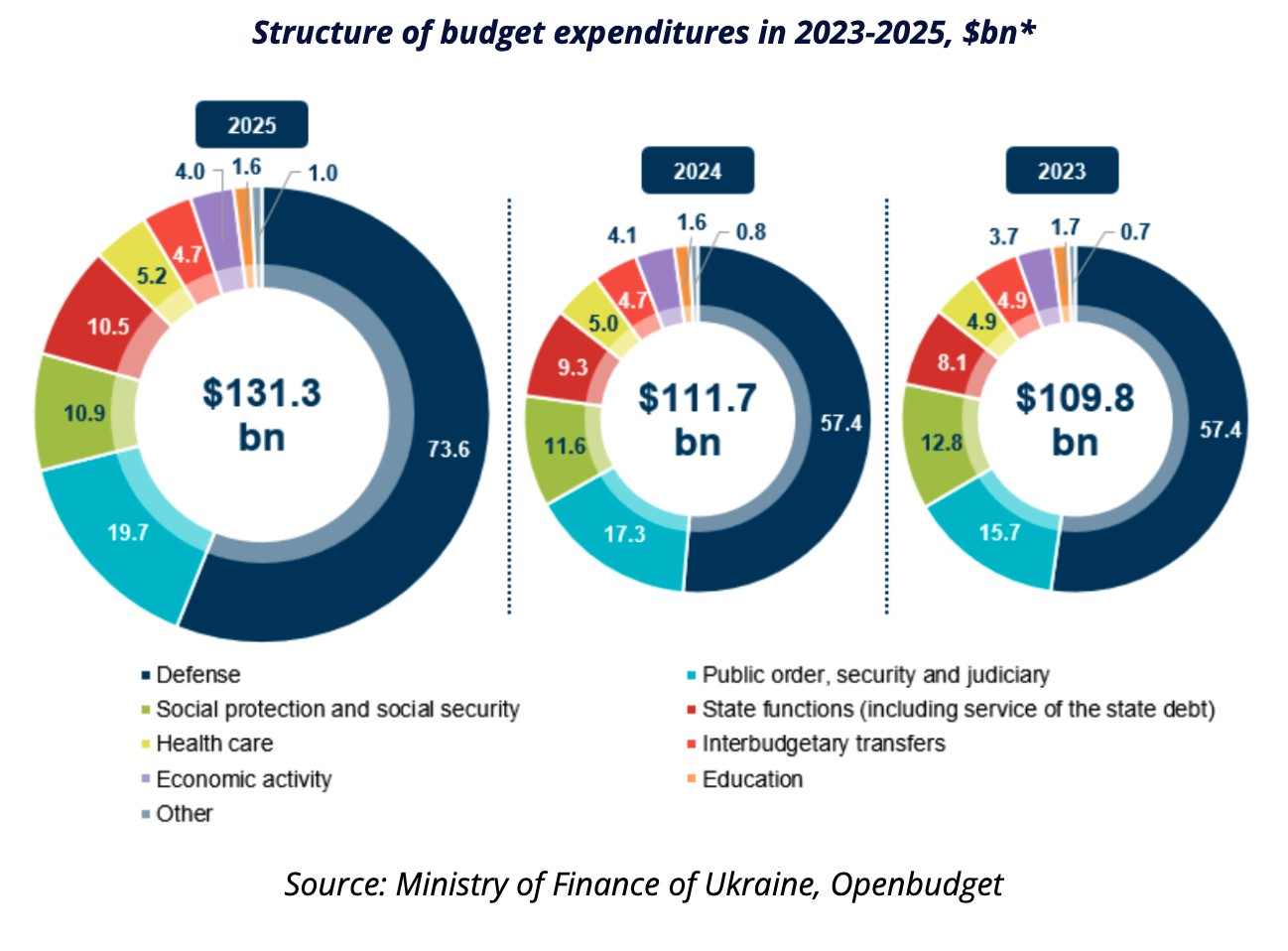

Ukraine's total budget expenses in 2025 reached a historic high of $131.4bn, according to the Fiscal Digest from the KSE Institute in its latest economic update.

The main reason is the constant growth of defence and security needs, which accounted for 71% of total expenses or $93.3bn and consistently exceeded revenues. The key items of spending were operational expenses on the armed forces, procurement, modernisation and repair of weapons, and an increase in average monthly defence spending. Thus, another year of full-scale war increased the overall budget deficit to $39.2bn.

Against the backdrop of rising war-related expenditures, social protection spending decreased by 6.2%. Reforms in the pension system and stricter eligibility rules for supporting vulnerable groups made it possible to reduce expenditures in the social and economic sector.

The 2026 Budget retains key programmes from previous years. At the same time, a set of new initiatives in the defence and social sectors has been introduced. Among the key innovations is a $4.4bn reserve for the defence and security sectors to respond to crisis risks. Social priorities include raising teachers' salaries, funding preventive medical check-ups, and expanding support for pensioners, vulnerable groups, families with children, and people with disabilities.

Total spending is planned at $104.3bn, with $61.4bn going to security and defence. The decrease in spending compared to 2025 is due to exchange rate and currency differences and the calculation methodology of the Ministry of Finance of Ukraine, which does not take into account military assistance provided in-kind.

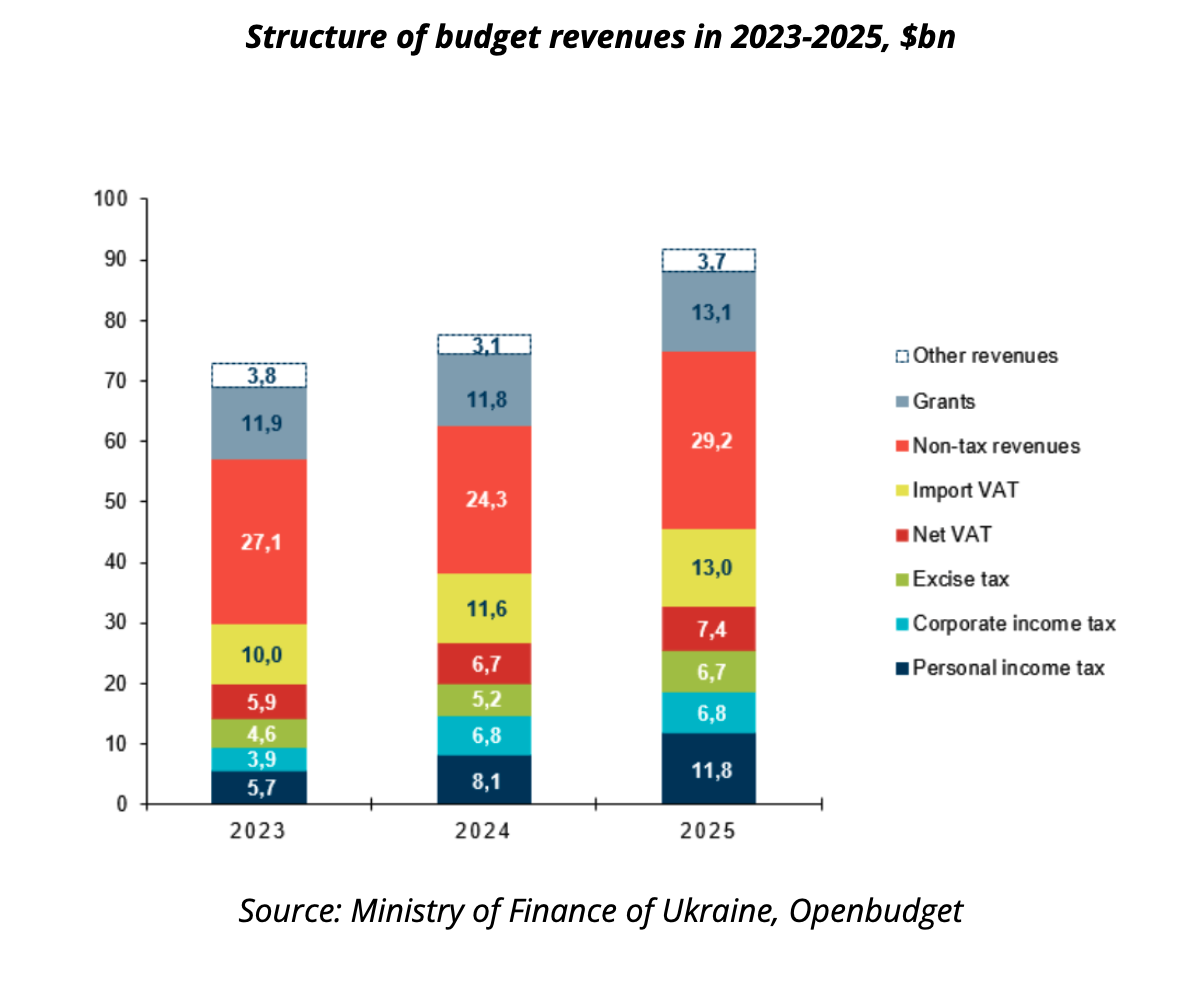

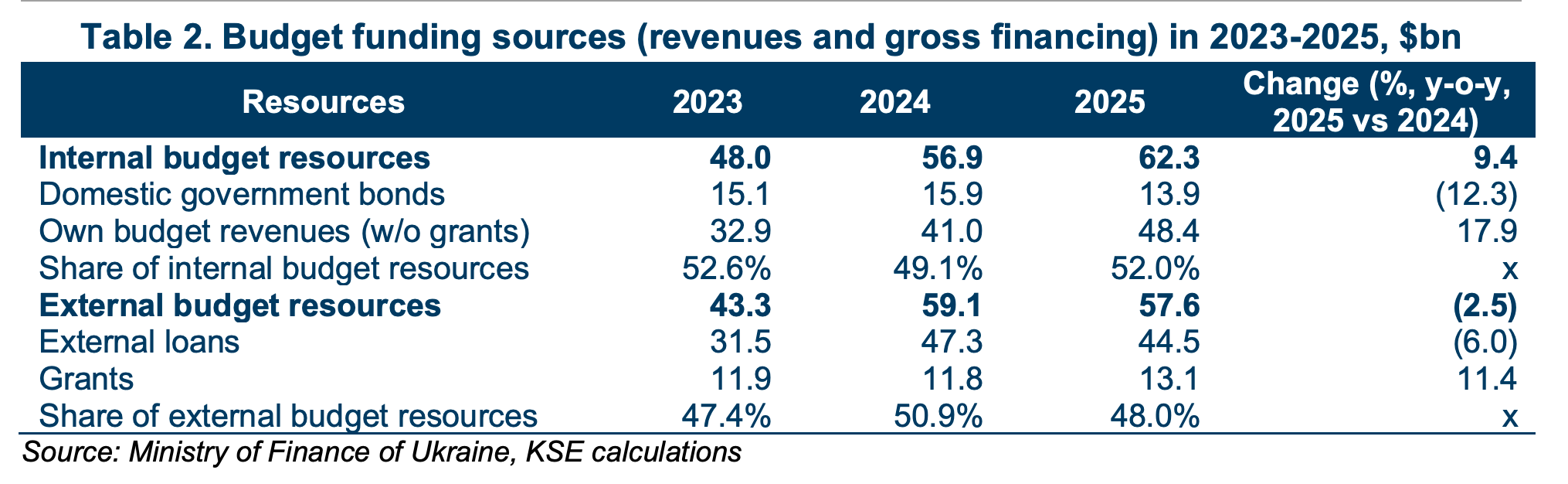

Budget revenues in 2025 increased to $92bn (+18.3% compared to last year). This was mainly due to ongoing large-scale support from international partners and changes in tax policy that increased tax revenues. In 2025, the state budget received $13.1bn, which is 11.4% more than in 2024. The main amount of grants came from the World Bank - $12.1 bn (under the ERA mechanism), with the rest coming from the EU.

Taxes, which accounted for 52.6% of total state budget revenues, became the main domestic source of funding for war-related expenses. In 2025, tax revenues reached $48.4bn, increasing by 17.9% compared to 2024, mainly due to higher revenues from personal income tax (PIT) and military tax. Despite this, tax revenues were $2.3bn or 4.8% below target due to increased attacks on the energy sector and macroeconomic indicators differing from forecasts. In particular, the exchange rate was stronger than expected, and the volume/share of taxable imports was lower.

Tax revenues are expected to continue growing, mainly due to higher taxation of bank profits, new excises, taxes on digital platforms, and improvements in tax and customs administration. The 2026 budget forecasts total revenues of $63.6bn, of which $54.4bn will come from tax revenues (+12.4% compared to the previous year). 5% of revenues, or $3.2bn, will come from the profits of the National Bank of Ukraine. Grants are projected at $833.7mn (1.3% of total revenues).

In December 2025, the European Council approved a new instrument to support Ukraine – a €90bn loan for 2026–2027, which will be repaid only after receiving reparations from Russia. €30bn will be allocated as general budget support and €60bn for military aid. This will significantly increase the government's ability to finance defence needs and core budget expenditures. In addition, the IMF and Ukraine have reached a staff-level agreement on a new four-year programme worth $8.1bn.

In 2026, Ukraine is expected to receive $46.6bn from foreign partners. This amount includes financial support from the EU under the Ukraine Facility, funding from the US, Japanese and Canadian governments under the ERA mechanism, guaranteed by revenues from frozen Russian assets, IMF and World Bank loans, and others.

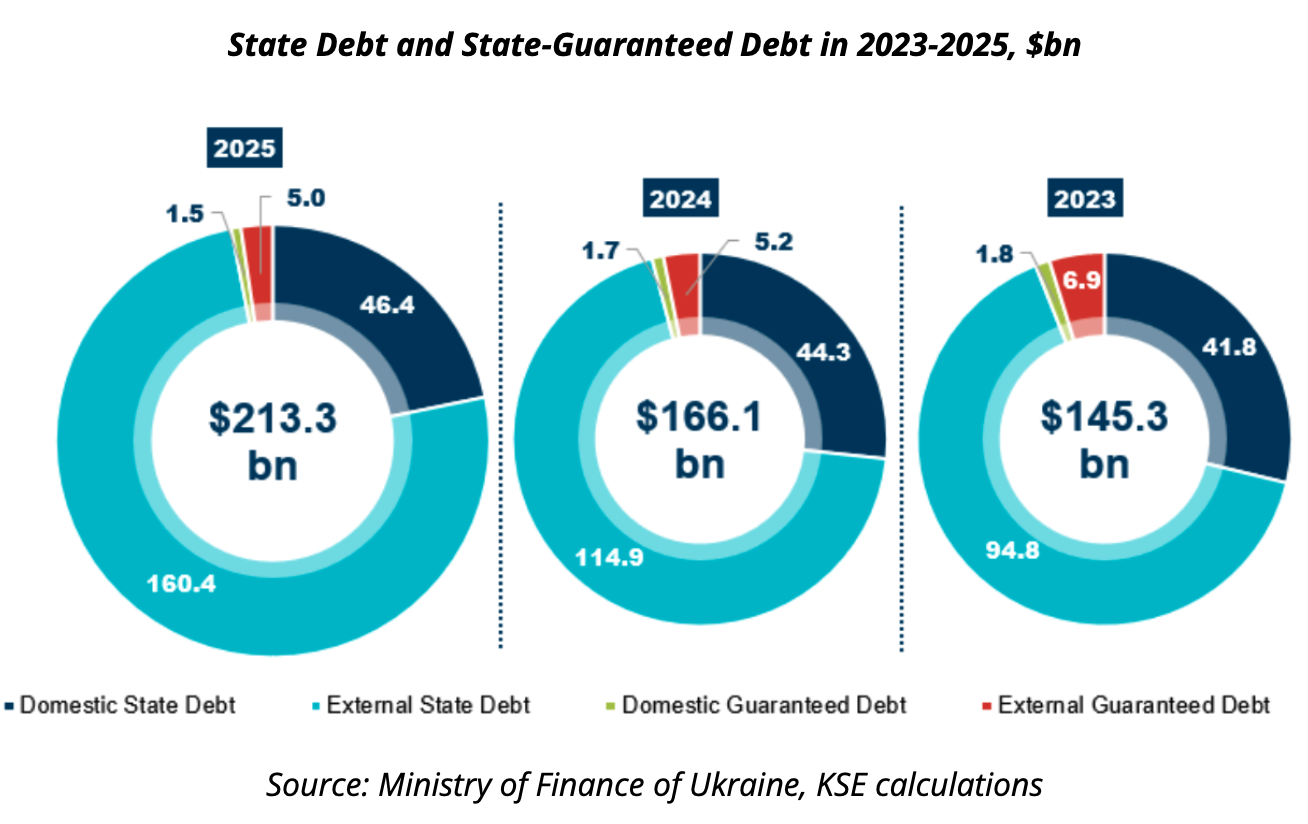

In 2025, Ukraine's public and publicly guaranteed debt increased significantly amid a persistent budget deficit. At the end of the year, the total amount reached $213.3bn, which is 28.4% more than at the end of 2024. In 2026, debt will continue to grow due to new borrowings and is likely to reach $239.1bn (106% of GDP). A turning point in 2025 was the government's approval of the Medium-Term Debt Management Strategy. Another important achievement was the agreement on restructuring the national debt and easing creditors' requirements at the end of the year. This made it possible to contain financial risks and strengthen overall fiscal stability.

Key Risks for 2026

Macroeconomic and security vulnerability of revenues. Despite the planned growth in revenues, their actual performance in 2026 will remain sensitive to the military situation and overall economic dynamics. A deterioration in the security environment could narrow the tax base due to production stoppages, logistics disruptions, and reduced exports, increasing the risk of revenue shortfalls and making the revenue side of the budget more volatile.

Institutional and behavioural risks of tax administration. A significant part of the revenue growth is based on de-shadowing and improving administration, primarily in customs and tax debt management; the effectiveness of this depends on the real capacity of institutions to implement reforms. At the same time, increased taxation of banks and the introduction of new taxes may encourage tax evasion, shift the tax burden to consumers, or curb investment activity, which together will limit the real fiscal effect and weaken the budget revenue base.

Risks related to international financial assistance. The overwhelming majority of confirmed financial support commitments from international partners are conditional on the Ukrainian government meeting specific policy and reform requirements, without which disbursements will not be made. The newly announced €90 bn EU support package is no exception. In the context of a fragile domestic political environment and a weak parliamentary coalition – which has already manifested in difficulties passing required legislation – there is a heightened risk of delays or partial non-compliance with conditionalities, potentially disrupting the timely receipt of external financing. Overall, the final framework of this program has yet to be determined, as have the ultimate funding volumes to be provided in line with Ukraine's needs. The same applies to the new IMF program, which is not yet approved, with a risk that it may not be implemented or could proceed with different funding amounts.

Political-cycle risks to expenditure discipline. Expectations related to the launch of a new electoral cycle may create incentives for expanding populist spending initiatives that are not supported by stable and sustainable financing sources. Such pressures could complicate fiscal planning, increase demands for additional revenues or debt financing, and weaken adherence to budgetary discipline, particularly in the pre-election period.

Read the entire report here.

Unlock premium news, Start your free trial today.