EU locks in access to South American lithium and critical minerals

The European Union has secured preferential access to vast reserves of critical minerals and agricultural commodities through its newly signed trade agreement with Mercosur, positioning the long-negotiated accord as much a geopolitical manoeuvre as an economic arrangement.

The pact, signed on January 17 in Asunción, grants the EU's 27 member states improved access to South American supplies of lithium, niobium, graphite and other materials essential for batteries, renewable energy systems and advanced manufacturing – resources currently dominated by Chinese processing and production.

"Brazil has the second-largest reserve, but it needs investment, procurement agreements and long-term contracts — and that is exactly what we want and need," EU Trade Commissioner Maroš Šefčovič told EFE.

The agreement progressively eliminates over 90% of bilateral tariffs and creates one of the world's largest free trade zones covering roughly 780mn consumers. But European officials have made clear that diversifying critical mineral supply chains away from Beijing represents a core strategic objective as Washington and Brussels compete for influence in resource-rich Latin America.

European Commission President Ursula von der Leyen hailed the deal as both an economic opportunity and a values-based partnership. "We are creating the largest free trade zone in the world, together. A shared market of 700mn people," she said at the signing ceremony. "It means better access to critical raw materials" for European companies, she added, emphasising the strategic dimension alongside commercial benefits.

Resource breakdown by country

Brazil dominates the mineral portfolio that Europe is seeking to tap. The South American giant accounts for approximately 10% of global aluminium extraction, 13% of graphite production, and 16% of tantalum output, according to German research cited by DW. It also controls the global market for niobium, a metal used in steel production and superconducting magnets including those in CERN’s Large Hadron Collider near Geneva.

The country additionally provides significant oil and petroleum products, along with iron ore and other metalliferous materials that flow into European manufacturing sectors. Natural graphite and manganese from Brazil are particularly valuable for battery production and advanced electronics applications.

Argentina brings substantial lithium deposits to the arrangement, ranking among the world's top producers of the battery mineral that has become critical for electric vehicle production and energy storage systems. The country also offers significant soybean production, oilseeds and vegetable oils, along with beef that benefits from expanded quota access under the deal. Non-fuel raw materials and chemicals represent around 12% of Argentina's exports to the EU.

Paraguay and Uruguay contribute primarily through agricultural exports, particularly soybeans, beef and sugar. Uruguay also provides pulp and paper products that factor into European industrial supply chains, representing a notable export segment for the smaller South American nation. Both countries produce cattle products, though from smaller production bases than their larger neighbours.

Bolivia, the newest Mercosur member, is not included in the current trade deal but could join in the coming years. The Andean nation sits atop one of the world's largest known lithium reserves, potentially enhancing the bloc's appeal to European industries once full accession is achieved. Bolivia also possesses important natural gas reserves and other critical inputs including borates and industrial minerals used in ceramics, glass and chemical industries.

Tariff elimination and market access

The agreement will axe import duties on over 91% of EU goods exported to Mercosur, whilst eliminating tariffs on 92% of the South American bloc's exports to Europe, according to European Commission data. This translates to approximately €4bn in annual tariff savings for European companies alone.

For critical raw materials specifically, the EU has won important concessions on export restrictions. Argentina, Uruguay and Paraguay have agreed not to restrict exports of industrial components or raw materials, whilst Brazil committed that any export taxes it imposes will be halved for shipments to the EU, a provision designed to ensure stable European access to strategic inputs.

Under the terms of the agreement, the EU will progressively curb import tariffs on a wide range of minerals and mineral compounds exported from Mercosur countries. In many cases, tariff reductions will occur within four to five years of the agreement's entry into force, with some products benefiting from immediate duty-free access. Whilst key commodities such as iron ore already entered the EU tariff-free prior to the deal, the new framework significantly improves access for processed and semi-processed mineral products.

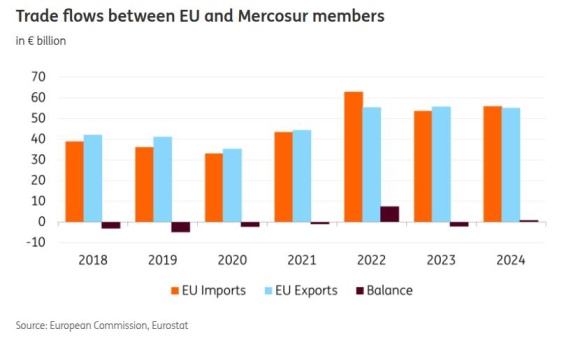

The deal also opens Mercosur government procurement markets to European firms at both federal and state levels, eliminates export monopolies, and reduces discriminatory tax treatment on imported goods. According to Commission projections, EU exports to Mercosur could grow by up to €50bn once the agreement is fully implemented, whilst Mercosur exports might increase by up to €9bn.

Agricultural commodities and quotas

Beyond minerals, the accord expands EU access to South American agricultural production, though strict quotas limit potential market disruption that could impact European farmers. Brazil, Argentina, Paraguay and Uruguay collectively export soybeans and derivatives, beef, poultry, sugar and ethanol – categories that represent approximately 42.7% of Mercosur's exports to the EU according to trade statistics.

Agricultural and food products account for the largest share of EU imports from Mercosur, with a total import value of €24bn in 2024, representing 43% of total imports from the bloc. Soybeans and derivatives represent a major supplier category to the EU market, whilst Brazilian coffee, tea, cocoa and spices constitute significant export products.

Beef imports from Mercosur will be limited to 99,000 metric tonnes annually at a preferential tariff of 7.5%, equivalent to just 1.5% of European production and roughly half of current import levels of 206,000 metric tonnes. Poultry faces a cap of 180,000 metric tonnes, representing 1.3% of EU output, whilst sugar remains subject to quota restrictions.

Orange juice, coffee, cocoa and other agricultural products round out the South American export basket, with existing trade patterns showing Brazil as a global leader in citrus concentrate shipments. The country also provides significant ethanol supplies that feed into European biofuel industries and refining operations, continuing access via existing quotas that remain important for EU refining operations.

Von der Leyen pointed out the safeguards built into the agricultural provisions. "This agreement contains robust safeguards to protect [farmers'] livelihoods, and our sensitive agricultural sectors," she said, noting that the deal includes "substantial economic opportunities for many EU agri-food exporters" as well. The agreement safeguards 350 European geographical indications, protecting products like Italian Parmigiano Reggiano and French Champagne from counterfeiting in South American markets. These measures proved crucial in securing support from initially sceptical members including Italy, which extracted last-minute concessions before backing the deal.

Strategic timing and competitive dynamics

The mineral provisions carry particular weight as European demand for lithium batteries is projected to increase twelve-fold by 2030, whilst rare earth metal requirements for wind turbines and electric vehicles are expected to rise five to six times over the same period, according to European Commission projections. The EU's Critical Raw Materials Act seeks to reduce dependency on China by 2030 through diversified sourcing, increased recycling and domestic extraction targets.

Currently, China dominates the processing and production of critical minerals, a dependency that Brussels considers a critical weakness. The Mercosur pact is explicitly designed to secure stable supplies of essential raw materials, given that member countries are significant producers of materials such as graphite, niobium and manganese used in batteries, advanced electronics and strategic industrial applications.

Chile, which supplies 79% of the EU's refined lithium, already benefits from a separate trade agreement which came into force last year and contains a chapter dedicated solely to energy and raw materials. The Mercosur arrangement extends this strategic sourcing approach across a broader swath of South America, with Brazil holding substantial but largely underdeveloped reserves due to investment and infrastructure gaps.

If and when lithium-rich Bolivia fully joins Mercosur, these resources could become more integrated into EU supply chains, supporting green energy and tech sectors. The combined reserve base positions South America as a potential counterweight to Asian dominance in critical materials processing.

Šefčovič said the Mercosur deal is sending a message "that if someone prefers and believes in high tariffs and power politics, Mercosur and European countries representing more than 700mn people clearly believe in ... international law, predictability, certainty and the removal of trade barriers,” in a veiled swipe at US trade policies under President Donald Trump.

The timing carries added significance as the agreement was signed just as Trump announced 10% tariffs on eight European nations over their opposition to American control of Greenland. Von der Leyen portrayed the Mercosur deal as a bulwark against such disruption. "It reflects a clear and deliberate choice: We choose fair trade over tariffs. We choose a productive long-term partnership over isolation," she declared in what was widely seen as a rebuke of the Trump administration's approach.

Industrial integration and value chains

Beyond raw materials extraction, the agreement aims to facilitate industrial value chain integration between the two regions. The deal reduces tariffs on advanced mining machinery and equipment imported into Mercosur, which is expected to lower costs for Brazilian mining operations and facilitate access to high-end European technologies, especially from industrial hubs such as Germany and Sweden.

Importantly, the revised agreement preserves Brazil's ability to pursue industrial policies aimed at increasing domestic value addition. Unlike earlier versions of the deal, the current text allows Brazil to introduce export restrictions or taxes on critical minerals if deemed necessary to support local processing and downstream development. Yet export taxes Brazil might introduce on critical minerals would be subject to caps, with rates for EU shipments required to remain below those charged to other markets.

This flexibility reflects Brazil's broader ambition to move beyond raw material exports and capture greater economic value through refining, processing and manufacturing. Jorge Viana, president of Brazil's trade promotion agency ApexBrasil, said that "more than a third of what Brazil exports to the region consists of processed industrial products. We have excellent quality trade with the European Union."

Aloysio Nunes, head of strategic affairs at ApexBrasil Europe, estimates that Brazilian exports to the European Union will increase by $7bn under the new framework. The agreement is expected to strengthen legal certainty and improve the investment climate for European companies operating in Brazil, guaranteeing non-discriminatory treatment and the right of establishment for EU firms to invest in mining, processing and industrial projects without additional barriers.

Economic impact and implementation timeline

In an interview with Xinhua, Ignacio Bartesaghi, director of the Institute of International Business at the Catholic University of Uruguay, said the arrangement was carrying "more geopolitical than economic interest" from the EU's perspective, though its importance remains primarily economic for Mercosur. He noted the deal would have "a more focused impact on the agro-industry and the primary sector" for South American countries, "with some possibility in some manufacturing sectors."

The accord requires ratification by Mercosur member states' legislatures and the European Parliament before entering into force. Implementation is expected to unfold gradually over coming years as tariffs are phased out on different product categories, with some automotive tariffs taking up to 15% to eliminate fully. The staggered timeline for tariff elimination reflects Brazil's desire to protect its own automotive industry, with electric vehicles receiving preferential treatment over conventional vehicles.

The Commission estimates the agreement will add approximately €77.6bn, or 0.05%, to EU gross domestic product by 2040, whilst Mercosur economies could see a 0.25% boost over the same period. These modest aggregate figures mask more substantial sectoral impacts, particularly in critical minerals, automotive exports, and agricultural trade.

According to a joint statement from the Mercosur countries, the agreement grants preferential access to the EU, eliminating tariffs on 92% of the South American bloc's exports, valued at approximately $61bn. It also provides preferential access for an additional 7.5%, equivalent to $4.7bn.

The agreement's strategic significance extends well beyond its marginal projected economic impact, casting the EU-Mercosur partnership as a counterweight to mounting global trade disruptions. As the Trump administration pursues aggressive tariff policies and China floods global markets with subsidised industrial exports, Brussels has finally managed to secure a rules-based framework for accessing critical resources essential to Europe's green transition.

In an increasingly fractious geopolitical context, the deal offers a glimmer of optimism; it demonstrates that middle powers can still forge substantial economic alliances based on multilateral principles, even as the world's two largest economies weaponise trade policy. For European policymakers, diversifying away from Chinese mineral processing whilst opening new markets for struggling industries like automotive represents a rare opportunity to advance both economic security and commercial interests – provided the agreement clears its remaining political hurdles in the European Parliament and national legislatures.

Unlock premium news, Start your free trial today.