ALKES: 4+1 facts on Uzbekistan’s deeper investment market in 2025

In recent years, we have become used to seeing Uzbekistan consistently on the international agenda as a country of reforms. It is written about, talked about, debated, and forecasts are made. For a long time, investors viewed the country as a story of great potential — today, it is increasingly a story of capital, deals, and institutions.

The past year clearly showed how deep the market has become, not in theory or in presentations, but in real results, transactions and decisions. Below are 4+1 facts from the perspective of a local investment banking firm that best show how intense the country’s investment life became in 2025 and what the new market reality now looks like.

1) Confirmed Macro Improvements

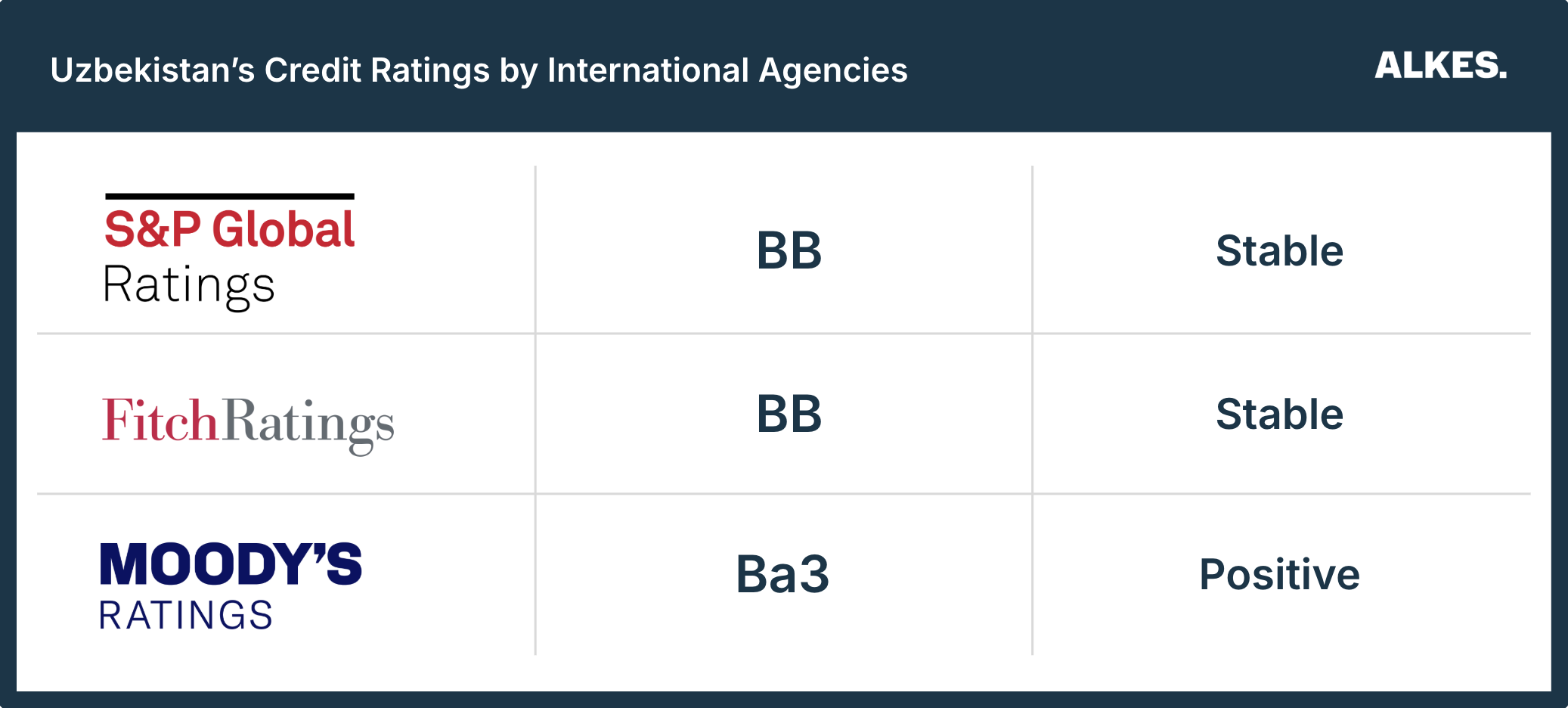

In 2025, Uzbekistan received an upgrade of its sovereign credit rating for the first time in seven years from leading international agencies. In June, Fitch upgraded the country from “BB-” to “BB” with a stable outlook, citing stronger macroeconomic resilience, growth of external reserves, and progress in structural reforms. Later, S&P also raised Uzbekistan’s sovereign rating to “BB” with a stable outlook, pointing to better institutional quality, solid economic growth, and lower vulnerability to external shocks. At the same time, Moody’s affirmed the rating at Ba3 and improved the outlook to positive, highlighting moderate debt levels and stronger fiscal discipline. These decisions directly affect borrowing costs, access to global capital, and how Uzbekistan is perceived as an investment destination.

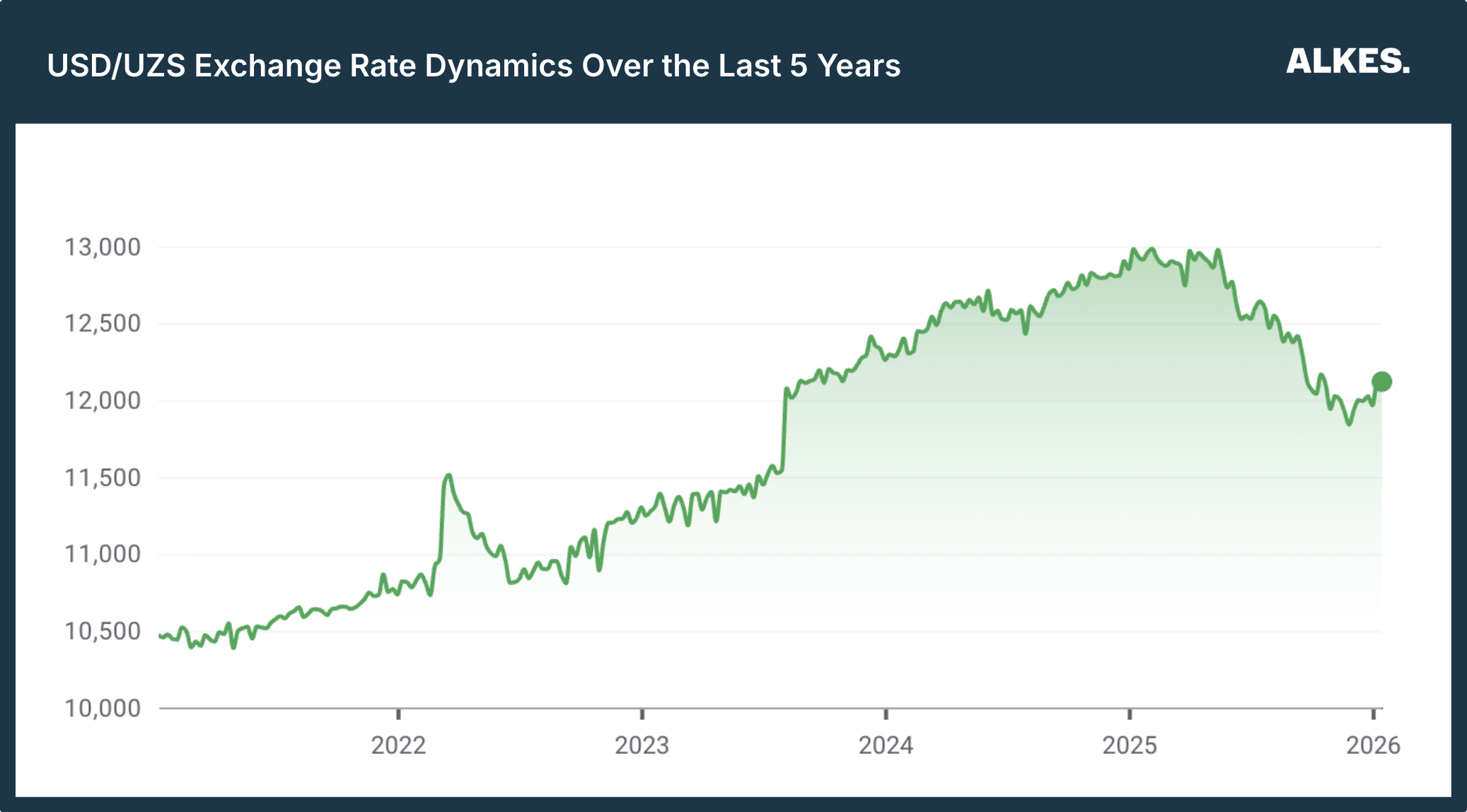

The most convincing number of the year, however, was the currency. For the first time in many years, the Uzbek som (UZS) broke its long-term devaluation trend. By the end of 2025, the national currency had strengthened by 6.93%. For comparison, in 2024 the som weakened by 4.71%, in 2023 by 9.92%, and in 2022 by 3.58%. At the beginning of 2025, the dollar was approaching UZS 13,000, after which a gradual strengthening of the som began. By the end of November, the dollar was trading around UZS 11,900, the lowest level at least since August 2023.

The Central Bank explains the strengthening of the national currency by a sharp increase in foreign currency inflows. Key factors include higher exports, inflows of foreign loans, growth in remittances, foreign direct investment, and relative stabilisation of imports.

The stronger currency also had a direct financial effect. The cost of servicing external debt declined, by 4.7% for the government and by about 5% for the private sector. At the same time, the de-dollarisation of the economy accelerated. In the first ten months of 2025, the share of foreign-currency loans fell from 41% to 38%, and the share of foreign-currency deposits from 26% to 23%. Since 2021, the pace of de-dollarization has amounted to a cumulative reduction of 10 percentage points in loans and 16 percentage points in deposits.

Confidence in the UZS has also been shown by global equity investors. In a recent interview, well-known American investor Jim Rogers said that his portfolio includes shares of Uzbek companies and that he believes in the Uzbek currency, the UZS, without hedging the currency risk.

One of the key pillars of macroeconomic stability remains foreign exchange reserves. By the end of the year, the Central Bank’s international assets reached $66.31bn. In one month alone, reserves increased by $5.07bn, or 8.3%, and over the year they grew by 61%. The foreign currency part of reserves stood at $10.64bn, including $1.48bn held with foreign central banks and the IMF, and $7.6bn on accounts with foreign financial institutions. The Central Bank’s portfolio of foreign securities also increased to $1.53bn. Taken together, this is an all-time high.

2) Continuing Momentum in Global Debt Markets

Against the backdrop of stronger macro indicators and a firmer national currency, Uzbekistan’s debt market received a strong boost in 2025, creating a solid base for raising capital both internationally and domestically. The country has been active in global debt markets for several years, but in 2025 a number of sovereign and corporate placements set a new benchmark in terms of volume, quality of demand, and cost of funding.

At the start of 2025, Uzbekistan issued sovereign eurobonds with a total size of $1.5bn. The deal was structured in three currencies: $500mn in US dollars, €500mn in euros, and UZS 6tn in the national currency. Proceeds were used to finance the budget deficit, housing and mortgage programmes, and green projects. Total demand exceeded $4.2bn, including $2bn in USD, €1.6bn in EUR, and UZS 7.3tn in UZS (equals to circa USD 575m). Coupons were set at 6.95% for the 7-year dollar tranche, 5.1% for the 4-year euro tranche, and 15.5% for the 3-year UZS tranche. These levels reflected strong investor interest in Uzbekistan’s sovereign risk at that time.

In the corporate segment of the international market, 2025 was especially active.

In October, Uzpromstroybank (SQB), one of the country’s largest banks, issued $300mn of Additional Tier 1 (AT1) bonds on the London Stock Exchange. More than 130 investors from 22 countries took part, and demand exceeded $1.4bn, almost five times the deal size. As a result, the coupon was set at 9.45%. This was the first Basel III–compliant AT1 issuance in Uzbekistan’s history. After the deal, the bank’s capital adequacy ratio increased from 15.9% to 19.0%, and Tier 1 capital from 11.3% to 14.7%. This creates room to raise up to $2.1bn of additional lending in 2026–2027 and supports further financing of industrial and infrastructure projects.

Ipoteka Bank, previously privatised by Hungary’s OTP Group, placed two tranches: $300mn for five years with a 6.45% coupon, and UZS 1.2tn (equals to circa USD 95m) for three years with a 17.5% coupon. The dollar tranche had the lowest coupon among financial institutions in the CEEMEA region with comparable ratings and deal sizes above $300mn since 2021. Both tranches priced 37.5 basis points inside initial guidance, one of the strongest spread tightenings in the region this year. This was a direct sign of investor confidence in Ipoteka Bank and in the effectiveness of Uzbekistan’s banking privatisation programme.

The National Bank of Uzbekistan, the country’s largest bank with 100% state ownership, placed $418mn in two tranches: $300mn for five years at 7.2%, and UZS 1.5tn (equals to circa USD 118m) for three years at 17.95%. Demand exceeded $1.3bn, allowing the bank to cut coupons versus its previous issues by 130 basis points in dollars (from 8.5% to 7.2%) and by 192.5 basis points in UZS (from 19.875% to 17.95%). For a systemically important bank of this size, this became a clear signal that the market has started to reassess Uzbekistan’s sovereign and quasi-sovereign risk.

Navoi Mining and Metallurgical Company, the world’s fourth-largest gold producer and a key foreign-currency earner for the country, placed $500mn five-year bonds at a 6.75% coupon. Demand exceeded $2.3bn, more than 4.6 times the deal size. For a company of this scale, this showed that global investors are ready to engage actively with Uzbek corporate risk not only in the financial sector, but also in strategic commodity industries.

Navoiyuran, one of the world’s top five uranium producers, completed its debut international bond issue of $300mn. Demand from 93 investors exceeded $1.3bn, allowing the coupon to be set at 6.7%.

Uzbekneftegaz placed $850mn bonds at a 8.75% coupon, setting a record for the largest single corporate bond placement in the country’s history. Demand exceeded $1.9bn, which allowed the company to tighten the coupon by 37.5–50 basis points and increase the deal size above the initial target.

A separate milestone was the Asian Development Bank’s first bond issue denominated in UZS, totalling UZS 312bn (about $24.7mn), with a three-year maturity and a 14.5% coupon. The deal was arranged by Merrill Lynch International. Proceeds were directed into supporting women-owned businesses outside the capital city.

3) Domestic Debt Market as a Growing Structural Funding Pillar

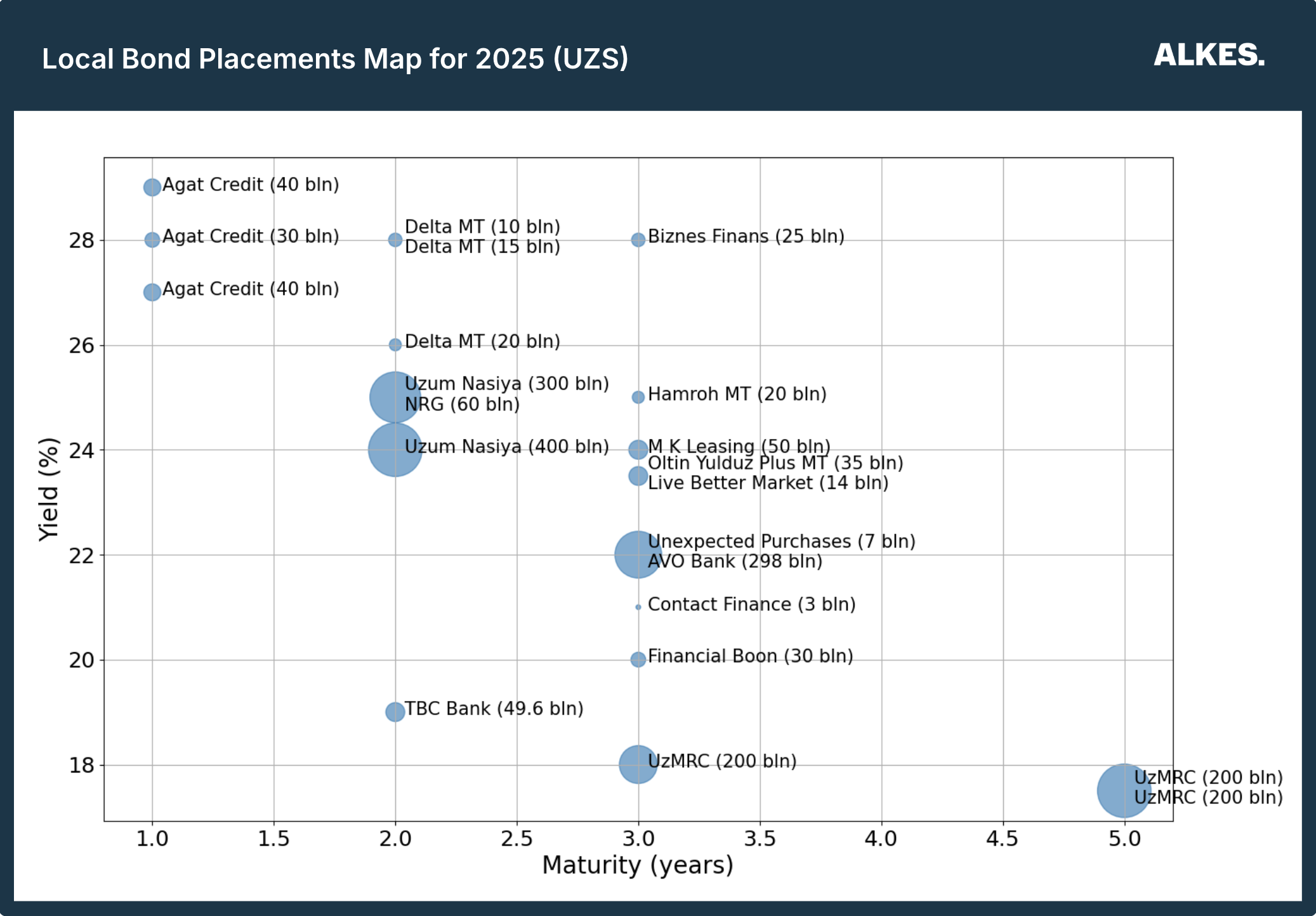

At the same time as strong activity in international markets, 2025 also became the year of domestic DCM. Bonds established themselves as a working funding tool both for the country’s leading financial institutions and for a number of microfinance organisations. They became a regular part of funding structures, not a one-off borrowing option.

Uzbekistan’s first technology unicorn, the Uzum ecosystem, placed two two-year tranches of UZS 300bn (or approximately USD 23.7m) and UZS 400bn (circa USD 31.6m) at coupons of 25% and 24%. Both became record public bond offerings on the Tashkent Stock Exchange and attracted retail investors, local institutions, and well-known international institutional investors. At the end of the year, the company also announced another planned issue of UZS 300bn.

TBC UZ, the leading digital bank and part of London-listed TBC Bank Group PLC, placed its third bond issue of almost UZS 50bn (or about USD 4m) at a 19% coupon with participation from foreign investors and is already considering new placements.

The Mortgage Refinancing Company (UzMRC), the market’s most frequent issuer with seven tranches to date, placed UZS 400bn (or equivalent of USD 31.6m) under the country’s first bond programme and another UZS 200bn (about USD 15.8m) via a private placement to commercial banks. The company also launched an SPV within the regulatory sandbox to issue the country’s first mortgage-backed bonds, secured by the securitisation of loans from five banks.

In 2025, around 12,000 corporate bond transactions were executed on the Tashkent Stock Exchange with a total volume of UZS 1.7tn (circa USD 134m). In total, 23 bond issues from 11 issuers were placed. It is also important to note the growing role of local institutional investors. Banks and insurance companies, which previously had almost no presence in the bond market and mainly allocated funds into collateralised lending, within just one year became anchor investors in new issues and started to work with this instrument on a systematic basis.

In the government bond market, trading volume reached UZS 530.4tn (about USD 41.8m), an increase of close to 755% compared with the previous year.

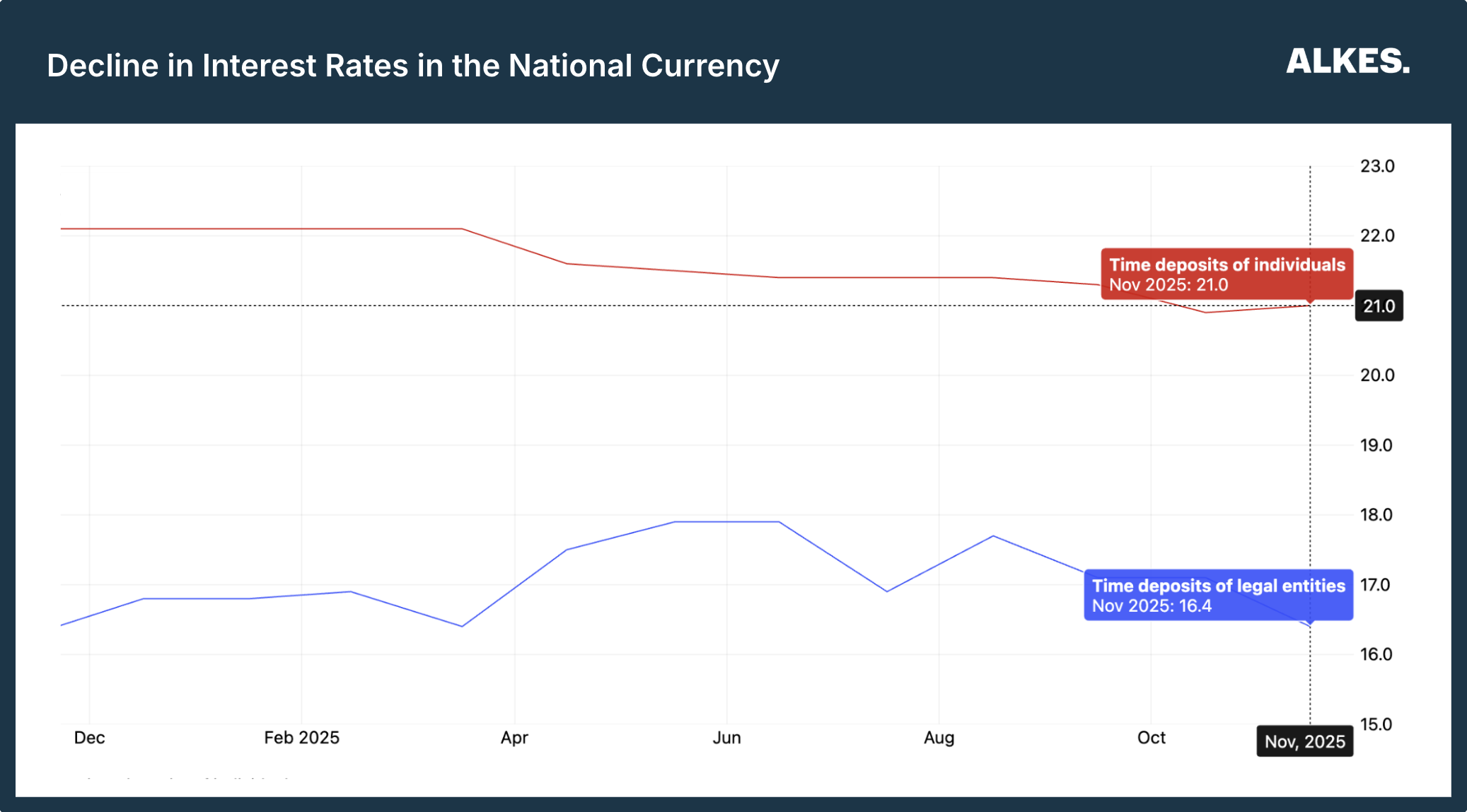

Against the backdrop of declining deposit rates, improving regulation, and stronger capital market infrastructure, domestic bonds in 2026 have all the prerequisites to grow further as a key channel for raising funding.

3) M&A as a New Normal

2025 became the most active year for the M&A market in Uzbekistan’s modern history. Deals stopped being isolated episodes and turned into a steady flow that is already reshaping entire sectors for years ahead.

In technology and fintech, several landmark deals took place. At the start of the year, Paynet privatised the HUMO payment system for $65mn, one of the country’s key infrastructure players with more than 35 million cards issued. The Uzum digital ecosystem raised $70mn from Tencent and VR Capital at a valuation of about $1.5bn, marking the first time a global tech giant of Tencent’s scale entered the equity of an Uzbek company. Kazakhstan’s Halyk Bank agreed with Click’s shareholders on a $237mn share swap, valuing Click at $360mn and Tenge Bank at $124mn. TBC completed two acquisitions: a controlling stake in OLX Uzbekistan, the country’s largest classifieds platform, and 53% of the SaaS platform BILLZ for $9mn. Yandex Uzbekistan acquired 100% of Allplay, the leading local streaming service.

Activity in the energy sector was no less impressive. The sovereign fund Mubadala and TAQA each acquired 40% in an 875 MW combined-cycle power plant in Talimarjan under a 25-year power purchase agreement. Another UAE-based company, Global South Utilities, acquired 51% of Yashil Energiya and is investing $27mn in solar projects, mini-hydropower plants, and electric vehicle charging infrastructure.

Landmark deals also took place in the consumer sector. The largest retailer, Korzinka, raised $110mn in equity from Abu Dhabi Uzbek Investment and UzOman. Belarusian group Servolux acquired control of Saxovat, the market leader in poultry products and a key supplier to KFC. Georgian retail chain Daily entered Tashkent by acquiring control of the Bi1 hypermarket chain from France’s Schiever Group.

Privatisation also delivered major transactions. Anadolu Isuzu paid $80mn for the state stake in SamAuto. The coal mining company Boysuncoal was privatised with $20mn of investment commitments. A strong pipeline has already been formed for 2026, including the sale of mobile operator Mobiuz (final stage, three price finalists), the privatisation of the Sherobod cement plant (1.5m tonnes per year) and Shargunkumir coal company (900,000 tonnes per year) as a combined lot, the insurance company Uzagrosugurta, and other assets.

Venture capital activity also deserves separate attention. Funds such as Aloqa Ventures, IT Park Ventures and others invested more than $4mn in startups in the first half of the year alone, and for the full year, by our estimates, the angel and venture investment market exceeded $15mn. The government is placing a strong focus on the technology sector. Exports of IT services grew by 152% and reached almost $1bn, nearly 2.5 times higher than in 2024.

The year clearly showed that the M&A market in Uzbekistan has become a major force in reallocating capital, strengthening competition, and transforming entire sectors.

+1) Regulation Aligned with International Standards

Ahead of the new year, the government approved a comprehensive package of capital market reforms aimed at attracting more than $1bn of funding by expanding the range of instruments, including foreign-currency bonds, dual listings, global depositary receipts (GDRs), and exchange-traded funds (ETFs). A key element of the reforms is the expansion of the regulatory sandbox under the National Agency for Perspective Projects, allowing both local and foreign players to access the market through controlled pilot structures.

The regulatory sandbox has already proven to be a working mechanism. Its participants include Raiffeisen Bank, OTP Bank, TBC Capital (the first foreign member of the Tashkent Stock Exchange), Auerbach Grayson, and Bank of Georgia. For the market, this means a step-by-step admission of global players into the local infrastructure under clear and controlled rules.

In his annual address to parliament, the President stressed that the capital market is seen as an important institutional pillar of economic growth and that global depositaries should be brought into the national stock market. He also noted that the new Capital Market Law, developed together with international financial institutions, should be adopted as soon as possible. It was also announced that as early as next year, Uzbek companies will be able to list shares on international markets for the first time.

Major changes are also planned in the banking sector. In the coming years, the system is expected to be brought into line with the Basel Committee's 29 Core Principles for Effective Banking Supervision (BCPs). The focus is on the full transition of commercial banks to IFRS, implementation of Basel III standards, and the creation of a Financial Stability Council with participation from the government and the Central Bank. The introduction of Basel III is intended to ensure that the sector’s rapid quantitative growth is supported by high-quality risk management.

This reform block matters not by itself, but as a signal: the capital market and the financial sector are being built as a single system. An institutional architecture is being formed for them under clear international rules, and current results already speak for themselves. It is on this foundation that one of the strongest investment stories among Emerging Markets of this decade will be built.

Unlock premium news, Start your free trial today.

_and_US_Ambassador_to_Kyrgyzstan_Lesslie_Viguerie_(center)__050226.jpg)