Asian and Middle Eastern capital floods into Eurasia despite global slowdown

Asian investors poured about $20bn into Eurasian economies in 2024-2025, bucking a broader global downturn in cross-border investment, with nearly half of that growth coming from the Gulf states, according to a new report from the Eurasian Development Bank (EDB).

The inflows pushed the total stock of mutual investments between Eurasian countries and Asian partners to a record $176bn, the bank said, as economic ties between the two regions deepen even as geopolitical risks and high interest rates curb capital flows elsewhere.

The report, part of the EDB’s Monitoring of Mutual Investments (MMI) project, tracks foreign direct investment (FDI) between 13 Eurasian countries across Central Asia, the South Caucasus and Eastern Europe, and key Asian partners including China, India, Turkey, Vietnam and the Gulf states.

“We are observing steady growth in investment ties between the Gulf states and the Eurasian region. We expect this strong investment momentum to continue in the medium term, averaging 15% per year,” said Evgeny Vinokurov, chief economist at the EDB, in a press release from the development bank.

He added that the Gulf’s expanding footprint reflects more than just capital flows. “The Gulf states are making ‘mature’ investments. Investor companies are bringing advanced technologies to the region and contributing to the development of high-level industrial expertise.”

Record FDI

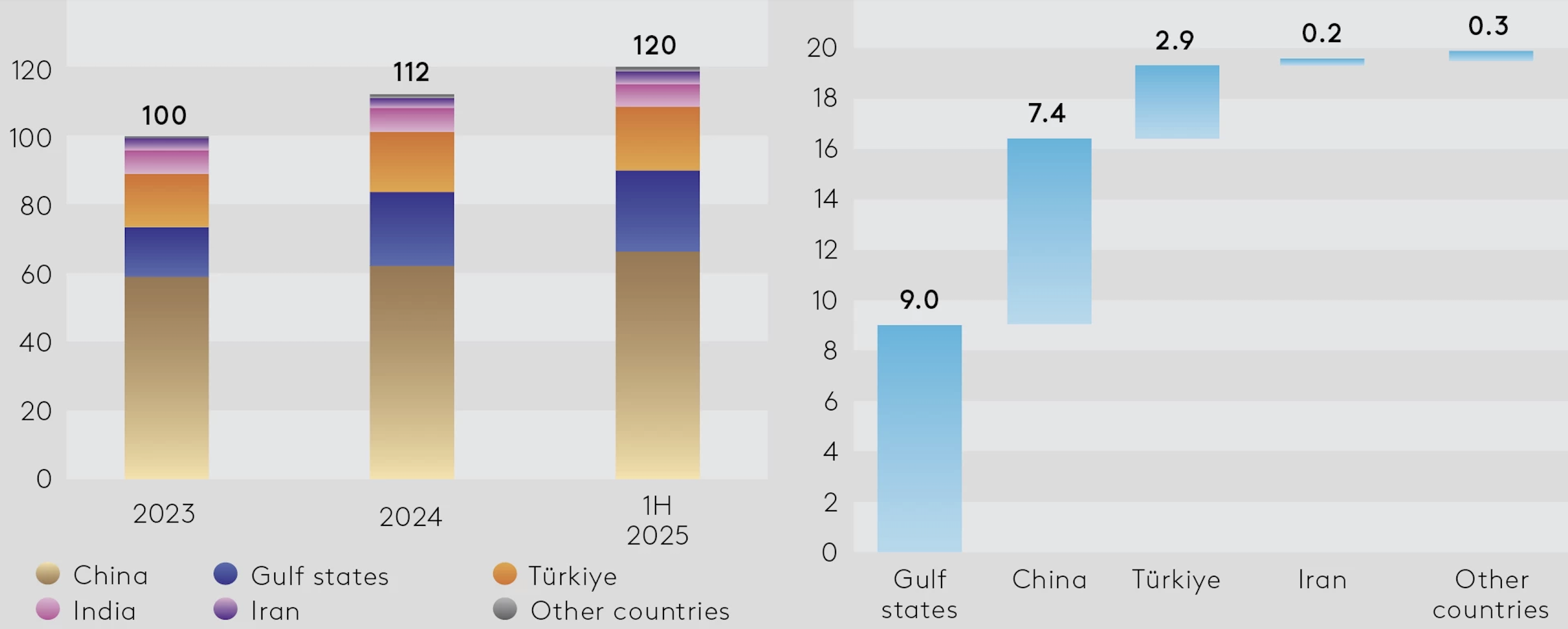

By mid-2025, FDI stock from Asian countries into the Eurasian region had reached $119.8bn, representing a 20% increase compared to 2023, the report found. That pushed the total two-way investment stock between the two regions to $176bn, double its level a decade earlier.

Investment stock from Asian countries in the Eurasian region (left) and investment growth by investor country from 2023 to the first half of 2025 (right), $bn. Source: EDB.

The bank said the figures are striking because they come at a time when global FDI flows have weakened, weighed down by higher borrowing costs, trade tensions and political uncertainty.

Almost all of the capital came from a handful of Asian economies. China remains the largest single investor, with $66.1bn, or 55% of total Asian FDI stock in the Eurasian region. It is followed by the Gulf states with $23.9bn (20%), Turkey with $12.3bn (15.5%), and India with $6.8bn (5.7%). Together, the four countries account for around 96% of all Asian investment in the region.

While China still dominates in absolute terms, the Gulf states have emerged as the main growth engine, according to the EDB report. Of the $20bn increase in Asian investment over the past year and a half, about $9bn, or 45%, came from Gulf investors.

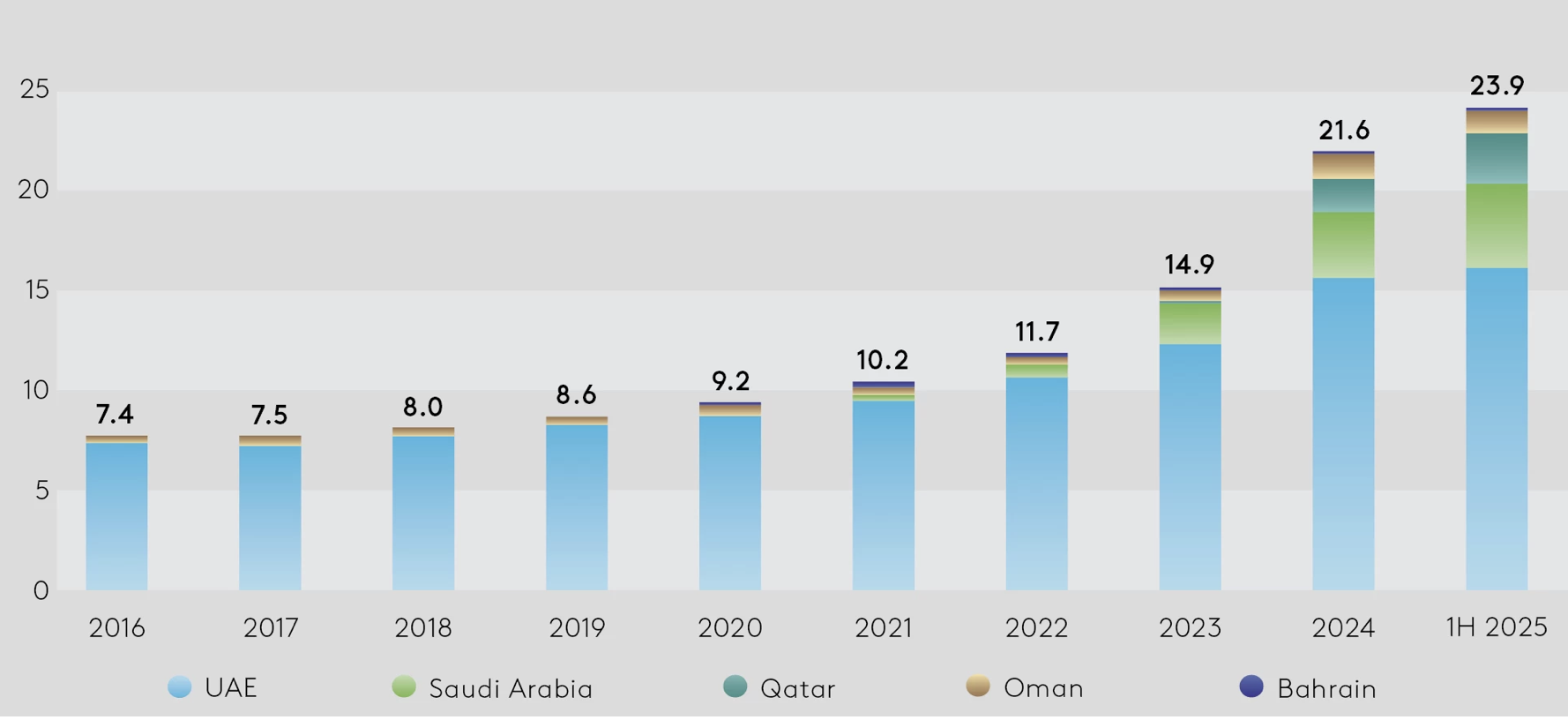

“Over the long term, the Gulf states have shown the highest rates of investment growth in the Eurasian region, averaging 13.9% per year since 2016, which is more than double the average rate of investment growth from Asian countries (6.8%),” the report said.

UAE leads Gulf push

Among Gulf investors, the United Arab Emirates (UAE) is by far the largest player, with $16.1bn in investment stock, representing 68% of the Gulf total. It is followed by Saudi Arabia with $4.2bn (18%), Qatar with $2.4bn (10%), and Oman with $1.1bn (5%).

Dynamics of FDI stock from the Gulf states to the Eurasian region, $bn. Source: EDB.

Within the Eurasian region, almost 96% of all Gulf investment is concentrated in Central Asia, reflecting a strategic focus on fast-growing economies rich in natural resources and infrastructure opportunities.

However, Gulf investors’ presence is expanding beyond Central Asia. The report shows growing Gulf investment in Azerbaijan ($0.6bn), Armenia ($0.17bn), Georgia ($0.16bn) and Kyrgyzstan ($0.1bn), among others.

China saw its investment stock in the region grow by 13%, or $7.4bn, over the same period.

Regional magnet

The report identifies Central Asia as the main destination for Asian capital, accounting for almost 57% of all Asian investment in the Eurasian region.

Cumulative investment from Asian countries into the five Central Asian economies rose 2.3 times between 2016 and mid-2025, from $29.9bn to $68bn, the EDB said.

“By the end of the first half of 2025, Central Asia accounted for up to 57% of the total accumulated direct investment attracted from Asian countries,” the report said, adding that the region’s share had risen sharply since 2023.

Investment is heavily concentrated in three countries — Kazakhstan, Turkmenistan and Uzbekistan — which together account for 92% of all Asian FDI in Central Asia.

Uzbekistan has been the standout performer. The report said its FDI stock from Asian countries has increased more than 45-fold since 2016, while in 2024-2025 alone it doubled from $11.0bn to $22.6bn.

That surge accounted for about 62% of total investment growth in Central Asia over the period, reflecting “improvements in the investment climate, industrial modernisation and power sector transformation,” the bank said.

Power sector attracts investment

The power sector has become the single most attractive destination for new Asian investment, driven by rising electricity demand and the region’s energy transition.

More than 84% of total mutual FDI between Eurasia and Asia is now concentrated in three sectors: extractive industries, power generation and manufacturing. But the balance is shifting.

Although extractive industries remain the largest recipient, their share has fallen from 55% in 2016 to 35% by mid-2025, while the power sector’s share has jumped almost tenfold, from 2.6% to 26% over the same period.

In just 18 months, from 2024 to mid-2025, power projects accounted for $10.1bn out of $19.8bn in new investment, or more than half of all growth, the report said.

The Gulf states and China are the most active investors in energy, including renewables. In that period alone, Gulf investors put about $5bn into power projects, lifting their power-sector investment stock to $8.3bn - slightly ahead of China’s $8.2bn.

The EDB said the shift reflects a combination of rapid growth in domestic electricity demand and the accelerating energy transition across Eurasia.

New Asian partners

Beyond China and the Gulf, the report highlights the growing role of India, Vietnam, Indonesia and Afghanistan as investment partners.

Investment cooperation with India is the most developed among the newer partners, with mutual investment stock reaching $13.4bn, split almost evenly between incoming and outgoing flows. Indian companies are mainly active in the oil and gas sectors of Russia and Azerbaijan.

Vietnam’s FDI stock in the Eurasian region grew from $613mn in 2016 to $825mn by mid-2025, while becoming more geographically and sectorally diverse. Although Russia remains its largest destination, its share has declined as Vietnamese companies expand in Kazakhstan, Kyrgyzstan and Uzbekistan, including in renewable power and real estate.

Indonesia is represented by a single major deal: Indorama Corp.’s acquisition of 99% of Uzbekistan’s FerganaAzot, combined with commitments to modernise the plant. By mid-2025, that investment was valued at $240mn, with further projects under discussion.

Afghanistan, though small in absolute terms, is seen as strategically important. Total mutual FDI stock reached $190mn, with investments largely tied to infrastructure and transit-power projects, including the TAPI gas pipeline.

Looking east

The flow of capital is not one-way. By mid-2025, Eurasian countries held $56.6bn in FDI stock in Asia, up 12.5%from a year earlier.

The main investors are Russia (72%) and Azerbaijan (23%), while the main destinations are Turkey (78% of all outflows), India (12%), Vietnam (4%) and China (2%).

Turkey is by far the largest recipient, with $44bn in investment stock from Eurasian countries — more than twice the volume of Turkish investment in Eurasia. Most of that comes from Russian and Azerbaijani companies in the energy and oil-refining sectors, though Kazakhstan has recently joined the ranks of major investors, led by large financial deals.

Investment from Eurasian countries in India has increased more than sevenfold, reaching $6.6bn, while Vietnam has attracted $2.35bn, mainly from Russia and Kazakhstan.

The EDB said the changing sectoral mix points to a broader transformation. “A steady structural shift is under way away from the dominance of extractive industries towards a more diversified investment model,” the report said.

By mid-2025, manufacturing accounted for 23% of mutual FDI stock, becoming a key driver of industrial cooperation across the region. With energy demand rising and governments accelerating green transitions, the bank expects the power sector to remain the main magnet for Asian capital, while Central Asia continues to consolidate its role as Eurasia’s primary investment hub.

Unlock premium news, Start your free trial today.