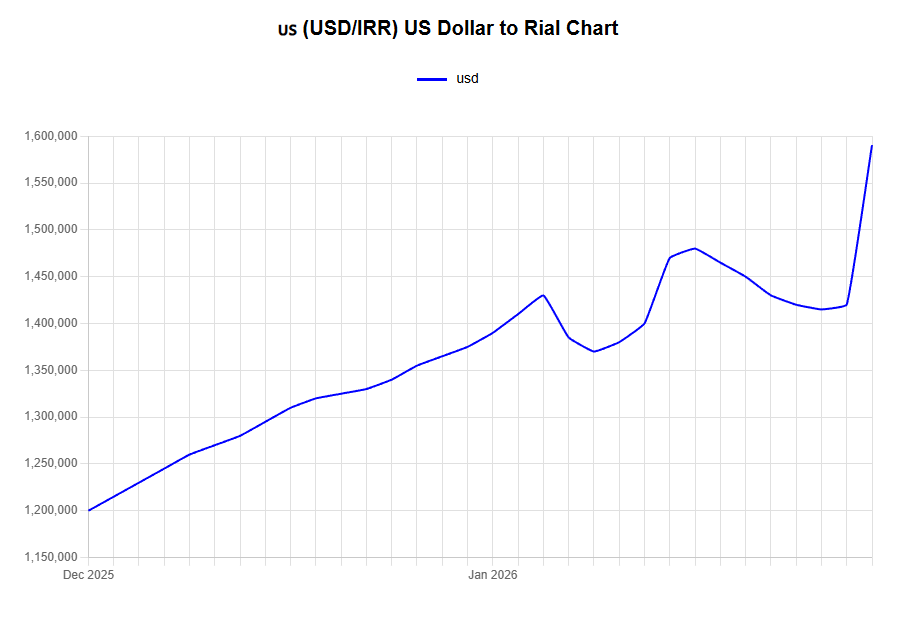

UPDATE: Iranian rial hits record low against US dollar at IRR1.62mn as country prepares for blockade

Iran's embattled rial hit a record low against the US dollar on January 28, trading at IRR1,620,500 on the sell side in the free market, according to Bonbast exchange rate data seen by IntelliNews.

The renewed rout in the currency comes as markets in Tehran and other cities have reopened after being effectively shut down across the country for more than two weeks due to ongoing protests and the declaration of martial law. Internet connectivity has also been nearly impossible and remains difficult to find regional market trading rates in locations such as Istanbul, Baghdad, and the Afghan border.

Markets are also jittery about reports coming into Ferdowsi Street about imminent military action against Iran by US President Donald Trump and his growing "armada" in the Persian Gulf. According to several Iranian social media channels citing Politico, an American military blockade of the region is imminent, with Iranian oil and gas facilities potentially being targeted in the next few hours.

The Iranian rial has never traded at such a weak level against the dollar, marking a historic depreciation for the currency. The rates published on January 28 at 16:45 UTC show the rial continuing its downward trajectory in free market trading on Ferdowsi Street, which has been closed for several days due to protests against the government.

Security forces are still patrolling the area and monitoring shops, according to one trader who spoke to bne IntelliNews by telephone on January 28. He said that buyers were purchasing dollars and gold despite the historic global prices, as the rial continues its downward trajectory.

"They closed the market for two weeks, we have had no phone or internet access, we have no idea if the rate we were quoted is even correct, and so many shops are refusing to sell," the person said.

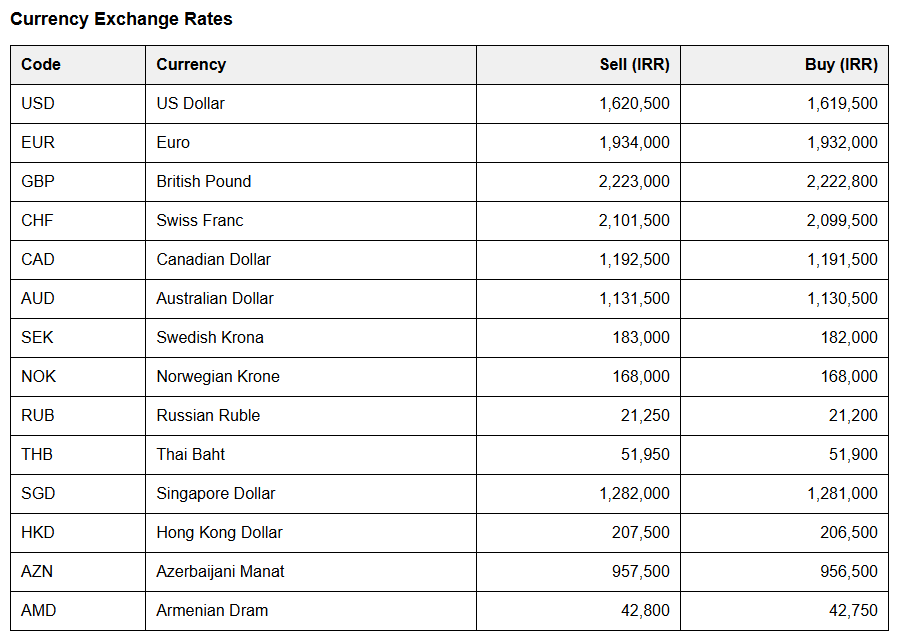

Other major currencies also reached record levels against the rial, with the British pound trading at IRR2,192,500 on the sell side and IRR2,190,500 on the buy side, whilst the euro stood at IRR1,906,000 sell and IRR1,904,000 buy.

The Swiss franc traded at IRR2,072,500 sell and IRR2,070,500 buy, the Canadian dollar at IRR1,172,000 sell and IRR1,171,000 buy, and the Australian dollar at IRR1,112,500 sell and IRR1,111,500 buy.

Regional currencies also showed significant rates against the rial, with the UAE dirham at IRR423,000 sell and IRR422,500 buy, and the Turkish lira at IRR51,200 sell and IRR51,150 buy.

Forex trader Kourosh Faghihi said increased foreign currency allocation by the Central Bank of Iran has created excess supply in the market, with clear signs visible in trading depth and rate behaviour.

"When the market trades at this volume and rates have limited fluctuations within a specific channel, the message is clear: the market is not facing a currency shortage," Faghihi said.

Official trading volume in the commercial foreign exchange market has remained at high levels, with total transactions exceeding $2.45bn over the past two weeks, according to Faghihi.

Offical markets also trending close but not keeping up

The dollar remittance rate in Iran's commercial foreign exchange market rose to IRR1,256,230 ($1) on January 28, according to the latest prices announced by the Foreign Exchange and Gold Market Centre, Hamshahri Online reported on January 28.

The euro remittance rate reached IRR1,504,910 whilst the UAE dirham stood at IRR342,060, according to the centre's announcement.

Since January 4, Iran has implemented a unified exchange rate policy at the Foreign Exchange and Gold Market Centre, merging the centre's two trading halls into a single unified hall. The remittance hall rate has become the basis for supplying currency for all goods and services, with all applicants receiving their required currency based on this rate.

According to the managing director of Iran's Foreign Exchange and Gold Market Centre, foreign exchange has officially become single-rate in the centre following this measure, and all applicants receive their required currency based on this rate.

The government and Central Bank of Iran recently limited preferential foreign exchange payments solely to wheat and pharmaceutical imports, whilst other goods and services must obtain their required currency from the centre's remittance hall based on daily negotiated rates.

Tehran Stock Exchange down

Iran's stock market index dropped 30,746 points on January 28 to reach 3,981,617 points, falling into the 3.9mn point range as the pace of decline slowed following six days of heavy losses, Hamshahri Online reported on January 28.

The Tehran Stock Exchange had previously risen to the 4.5mn point range before the recent selloff, which saw the index retreat by approximately 600,000 points over the past week. The equal-weighted index fell 13,684 points to 1,025,213 points.

Trading activity reached 830,000 transactions worth approximately IRR24,000bn ($15.1mn) on the stock exchange, whilst the over-the-counter market index dropped 512 points to 30,739 points with 491,000 transactions valued at IRR102,000bn ($64.2mn).

Unlock premium news, Start your free trial today.