Trump does an about-turn on Ukraine as his “minerals diplomacy” with Russia fails

Donald Trump did an abrupt about-turn on Ukraine during an hour-long rambling speech to the United Nations General Assembly (UNGA), saying Ukraine could recapture all its lost territory in the war with Russia, if the European Nato allies supply it with sufficient US-made weapons.

Trump told French President Emmanuel Macron be believes that Ukraine has the power to reclaim all of its lost territory. “I really do feel that way. Let them get their land back,” he said, adding that he sees Russia as a "paper tiger."

His change of heart is an admission that his “minerals diplomacy” has failed: in all the conflicts he has resolved or attempted to mediate, US business interests play a central role, specifically cutting mineral deals where possible.

Trump forced Ukraine into a disadvantageous minerals deal on April 30 that was described at first as “worse than Versailles” when he first engaged in the Russo-Ukraine conflict. At the , Ukrainian President Volodymyr Zelenskiy insisted the deal include concrete security guarantees, which Trump flatly refused to do saying the presence of US companies in Ukraine would be protection enough. And Trump has been trying to cut similar deals with Putin. Trump’s UN speech is a de facto admission that his minerals diplomacy with Russia is going nowhere.

UN drama

Trump met with Ukrainian President Volodymyr Zelenskiy on the sidelines of the UNGA meeting in New York. Pressed by reporters after the meeting, Zelenskiy said little, but indicated a major announcement was coming. However, Trump made it clear that the responsibility for financial support to pay for weapons sold to Ukraine rests with Europe.

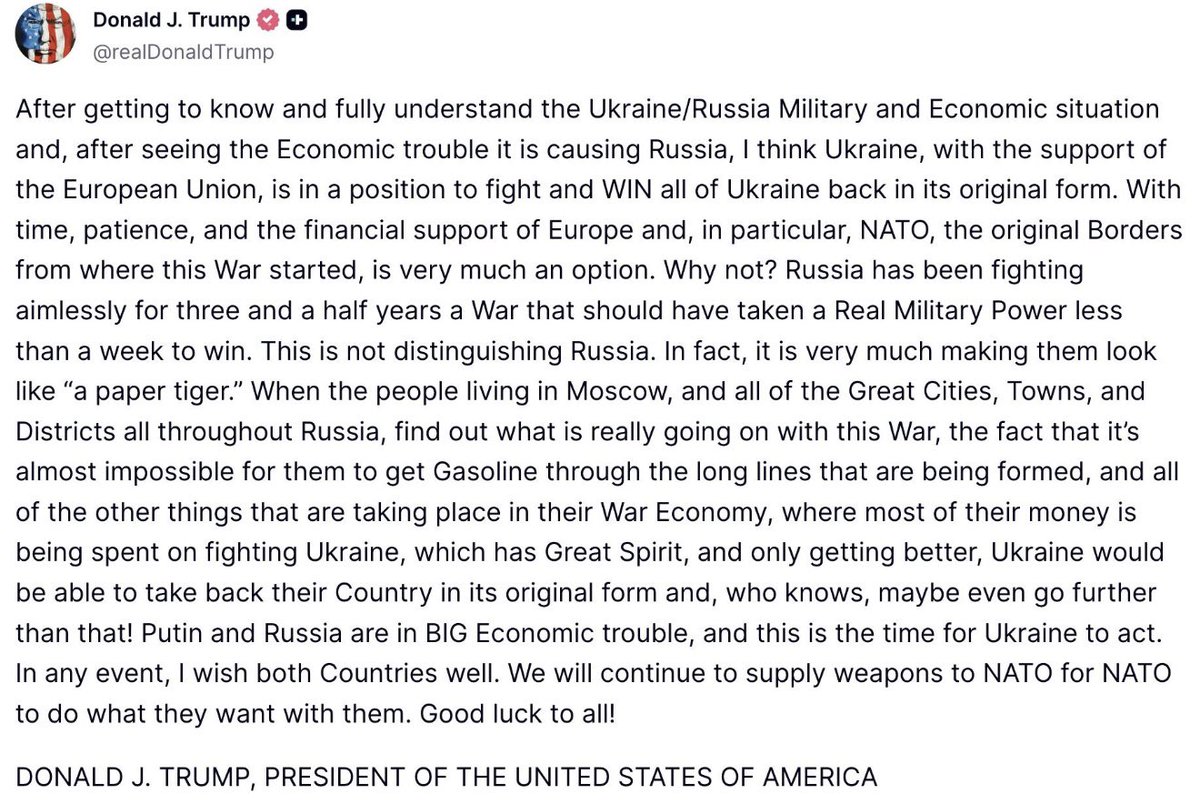

“Having reviewed and understood the military and economic situation of Ukraine and Russia, I believe that Ukraine, with the support of the EU, is capable of fighting and RETAKING all of Ukraine in its original form,” Trump wrote on his Truth Social account.

“Ukraine could go further,” he added. Calling Russia a “paper tiger,” he argued that Moscow faced “BIG economic problems” and that “most of the money is being spent on the war.”

At a joint briefing with Zelenskiy, Trump repeated his belief in the imminent collapse of the Russian economy, lamenting that his once “good relationship” with President Vladimir Putin had “turned out to mean nothing.”

Commentators have observed that the Trump-led peace initiative that kicked off in Riyadh on February 18 and peaked with his seven-point “final offer” peace plan in April in London, has now largely failed, after he pushed for a bilateral or trilateral meeting between Zelenskiy and Putin at the White House summit on August 18 that has gone nowhere.

Mineral diplomacy

As bne IntelliNews reported, there are two sets of talks running in parallel: Trump originally floated the idea of a 30-day ceasefire in February as a precursor to talks, but Russian President Vladimir Putin rejected that, unwilling to give up the military momentum the Armed Forces of Russia (AFR) has built up on the battlefield. However, in parallel to these diplomatic efforts, Trump has made it very plain that he is interested in tapping into Russia’s vast store of raw materials and wants to do business with Russia.

Access to minerals is a key part of the Trump administration’s policies, and he is prone to bullying companies at home as well as abroad: Reuters reported on September 24 that the Trump administration is demanding a 10% equity stake in Lithium Americas as it renegotiates terms of the company's $2.26 billion Energy Department loan for its Thacker Pass lithium project with General Motors.

As has been widely reported, the US’ almost total dependence on the Chinese monopoly on the production of critical minerals and rare earth metals (REMs) is a major strategic weakness; Trump was quickly forced to back down after he tried impose triple digit tariffs on China as part of his Liberation Day trade regime after Beijing started to squeeze exports of key elements to the US, which its tech sector is entirely dependent on.

Russia is a potential solution to this problem. It is home to the second largest deposits of REMs in the world after China and Putin is potentially open to doing deals with the US on joint production. However, no deals have been concluded so far.

During his UN speech, Trump rattled off a list of “impossible” conflicts he has brought to an end – and even managed to name “Armenia and Azerbaijan” correctly after confusing Azerbaijan with countries like “Albania” and “Columbia” on several occasions in the last week.

However, in each of these conflicts he has also cut mineral deals on the side as part of the talks, or at least business deals, although the Iran-Israel conflict is more complicated for obvious reasons. Trump's claims of ending conflicts are tied to his "America First" push for US access to critical minerals following his March 2025 Executive Order on domestic production. Many ceasefires include informal or formal mineral-related incentives, though not all, and some remain promises rather than finalized deals.

|

Trump’s conflict resolutions |

|||

|

Conflict |

Claimed Resolution Date |

Trump's Claim |

Mineral Deals/Promises |

|

India-Pakistan Border War |

May 10, 2025 |

Announced a "full and immediate ceasefire" after US-mediated talks, leveraging trade threats; called it a "possible nuclear disaster" averted. |

US-Pakistan oil reserves pact: Agreement grants US firms (e.g., ExxonMobil) preferential access to Pakistan's offshore oil/gas reserves (est. 10-15bn barrels) in exchange for tariff reductions (from 25% to 10% on Pakistani textiles) and $2bn in US aid; tied to ceasefire enforcement. |

|

Israel-Iran Conflict |

June 2025 |

Negotiated ceasefire after 12 days of Israeli strikes on Iranian nuclear sites (with US bunker-busting support) and Iranian retaliation; claimed he "ordered" the end. |

No mineral deal component with Israel, a long-standing ally of the US. General post-ceasefire sanctions relief talks with Iran, a major oil producer, including vague US interest in Iranian rare earths (e.g., neodymium deposits), but no formal deal—Trump floated "mineral swaps" for nuclear limits, rejected by Iran. |

|

Thailand-Cambodia Border Clash |

July 26, 2025 |

Pressured leaders via calls and trade threats for a ceasefire after three days of fighting (35+ deaths); posted about "war stoppage." |

No mineral deal component; brief talks touched on joint Mekong River mineral exploration (tin, gems), but no commitments—US offered $500mn in regional aid without mineral strings. |

|

Armenia-Azerbaijan Nagorno-Karabakh War |

August 2025 |

Brokered White House signing of a joint declaration for normalization, economic ties, and peace; first commitment since 1980s violence. |

TRIPP Corridor minerals transit: US granted 99-year exclusive development rights to the "Trump Route for International Peace and Prosperity" (TRIPP), a 25-mile trade corridor linking Armenia to Azerbaijan, facilitating US export of Caspian minerals (Azerbaijan oil/gas, Armenian copper/molybdenum) worth ~$5-7bn annually; includes joint venture with Bechtel for infrastructure. |

|

Democratic Republic of Congo (DRC) - M23 Rebels (Rwanda-Backed) |

August 2025 |

US-backed ceasefire deal after M23 captured Goma; claimed it ended eastern Congo's mineral-fueled war (100+ armed groups). |

Proposed US-DRC critical minerals investment: Deal offers US preferential access to cobalt/coltan reserves (est. 70% of global cobalt) via $10bn Reconstruction Fund in exchange for military aid and Rwanda sanctions lift; DRC president rejected "auction" of resources, calling it "neo-colonial"—talks stalled, but US firms (e.g., Freeport-McMoRan) secured pilot permits for 3 mines. |

|

Ethiopia-Egypt Nile Dam Dispute |

June-July 2025 |

Intervened to broker "peace for now" via aid suspension and talks; referenced first-term efforts. |

No mineral deal component; indirect link via US mediation offering Ethiopia port access in Somalia for mineral exports (potash, gold) in exchange for dam filling schedule concessions—Egypt vetoed, no deal. |

|

Serbia-Kosovo Tensions |

June 27, 2025 |

Prevented "big war" by threatening US trade cutoff; claimed Serbia and Kosovo were "going to go at it." |

Kosovo lithium exploration promise: Informal US pledge for $1.5bn investment in Kosovo's Trepča mines (Europe's largest lithium reserves, est. 200,000 tonnes) tied to economic normalization; Serbia excluded but offered separate rare earth talks—no binding agreements yet. |

|

Ukraine (Russia-Ukraine War) |

N/A (Ongoing) |

Trump claims progress toward "total victory" via minerals-for-peace framework, but war continues. |

US-Ukraine Mineral Resources Agreement: Signed April 30, 2025; creates joint $175bn Reconstruction Investment Fund giving US preferential access to Ukraine's rare earths/titanium (est. up to $500bn reserves) in exchange for aid/military support—Kyiv retains veto on sites; first lithium mine permits approved June 2025, with US firms (e.g., Rio Tinto) investing $2bn. |

|

Russia (Russia-Ukraine War) |

N/A (Ongoing) |

Trump floats "grand bargain" with Putin, including mineral incentives for withdrawal. |

Talks of US-Russia rare earth swap: Informal proposals (August 2025) to grant Russia access to Alaska's rare earth deposits (e.g., Bokan Mountain, est. 5mn tonnes) in exchange for Ukraine ceasefire and sanctions relief on Russian palladium/nickel—no formal deal, but Trump-Putin but discussions ongoing; US officials deny "bargaining chip" status. |

|

Source: bne IntelliNews, reports

|

|

|

|

Russian business talks

The head of Russia’s sovereign wealth fund Kirill Dmitriev said at the start of the talks that he was leading a “parallel track” with the US on developing business ties and has been present at all the high level meetings between Putin and top US officials, although he has released few details of the discussions.

During the Alaska summit on August 15 where the two presidents met, they reportedly discussed a deal that would lift aviation sanctions and allow US plane-maker Boeing to restart sales to Russia in exchange for access to Russia’s virtual monopoly on titanium production. Since then, Trump granted a similar sanctions relief deal for the Belarusian national carrier Belavia,which has had sanctions lifted following the release of 52 political prisoners on September 11.

Likewise, following the Anchorage meeting, Putin cleared the way for ExxonMobil’s return to the Sakhalin-1 oil project worth billions of dollars to the company. Putin has also offered Trump joint venture projects to develop Russia’s vast deposits of rare earth metals (REMs) and in Anchorage, Trump suggested that Russia and the US jointly develop Alaska’s REMs deposits.

However, all these efforts appear to have come to naught and now Trump appears to be giving up on negotiations. Earlier he said that he thought the Ukraine talks would be the easiest, but they have turned out to be the “toughest.”

Putin remains open to negotiations, keen to win significant sanctions relief, but only on his terms. While Trump remains on the job, he represents Putin’s best chance of getting some of the circa 30,000 sanctions on Russia lifted. But Putin has been uncompromising, insisting that Bankova (Ukraine’s equivalent of the Kremlin) concede to all his demands, which were laid out in the failed 2022 Istanbul peace deal and include: western recognition of Russia’s sovereignty over the five occupied regions; a legally binding no-Nato promise by Kyiv; a return to constitutional neutrality; and a reduction in the size of Ukraine’s military, among other things.

Zelenskiy has rejected all these demands and has insisted that an unconditional ceasefire be put in effect before any talks can even begin. He has also rejected ceding any territory to Russia out of hand, saying it violates Ukraine’s constitution.

As hopes that the conflict in Ukraine could end this year fade, observers are rerating and preparing for a long war. The IMF has just adjusted its outlook for Ukraine, increasingly its forecast for funding needs for 2026, up from $37.5bn to $65bn – a sum that Ukraine will struggle to find and threatens to cause a macroeconomic collapse, as bne IntelliNews detailed in a feature: Ukraine and Russia's budgets side-by-side.

However, Trump’s volte-face means the Trump administration will be much more willing to sell high-powered long-range weapons to Ukraine, as the Armed Forces of Ukraine (AFU) escalates its missile attacks on high value Russian economic assets, including trying to destroy Russian refineries that has already reduced production by 20% since August. Russia has economic problems and they are getting worse. Kyiv is hoping to improve its hand by reducing Russia’s ability to produce and export oil that is being used to fund the war, as Western sanctions on Russia’s oil business have largely failed.

Harder line, but still only rhetoric

Trump has significantly hardened his line on Russia after sitting on the fence since he took office in January. The US has sent Ukraine no money and Trump has imposed no new sanctions on Russia whatsoever since the start of the year.

Trump may not have totally given up on the idea of doing business with Putin. When asked whether he could still trust Russian President Vladimir Putin, Trump told reporters he would let them know in “about a month,” the Kyiv Post reports.

Asked by a journalist in New York whether Nato countries should shoot down Russian aircraft violating their airspace, he responded “yes.” Four Nato members have reported incursions into their airspace in just the last few weeks, starting with the Polish drone incursion on September 10.

Zelenskiy described his meeting with Trump as a “big shift,” while US media called Trump’s tone an “extraordinary turnaround.” Until now, he has repeatedly said Ukraine held a “bad hand” and that Zelenskiy had “no cards” to play adding that Zelenskiy will have to concede territory to halt the fighting. Trump’s new position marks the first time he has publicly declared Kyiv capable of winning the war.

However, observers are still taking Trump’s comments with a pinch of salt. The mercurial Trump has still made no mention of sanctions on Russia, either in the New York meeting or subsequent posts, and stressed repeatedly that it was Europe’s responsibility to fund Ukraine’s war effort.

“Putin and Russia have BIG economic problems, and now is the time for Ukraine to act,” he wrote, but emphasised that Washington’s role would be limited to continuing to supply Nato with weapons and only then if Washington gets paid for the aid.

According to some observers one way of seeing the change is that Trump has given up on the hope of cutting business deals with Putin and switching to his next best options for making money: boost weapons sales to Ukraine via Europe and forcing the EU to cut its imports of Russian oil and gas, increasing the imports of US hydrocarbons to replace them.

As part of his trade negotiations with the EU earlier this year, he persuaded European Commission President Ursula von der Leyen to commit to a promise to increase European imports of energy to $750bn over three years – a deal some commentators called “delusional.” The US has already largely replaced Russia as a major source of gas, creating a new dependency on American LNG.

US Secretary of State Marco Rubio confirmed the shift in emphasis, telling Fox News that “the US does not intend to impose new sanctions against Moscow as long as European countries continue to purchase Russian oil.” Following the recent Paris summit on September 4, Trump refused to back European peace plan proposals, insisting instead that the EU introduce secondary sanctions on China and India to curb their Russian oil business.

Rubio said European allies should act first to curb the Kremlin’s revenues and warned that Washington might also reconsider its mediation role. “The United States remains the only state that has the ability to speak with both sides of the conflict,” Rubio said.

The EU paid lip service to Trump’s demands in its latest nineteenth sanctions package, but has refused to use tariffs as a “political weapon”, von der Leyen said, and remains far more dependent on Chinese trade than the US is.

Unlock premium news, Start your free trial today.