Romania's manufacturing PMI starts 2026 with subdued reading

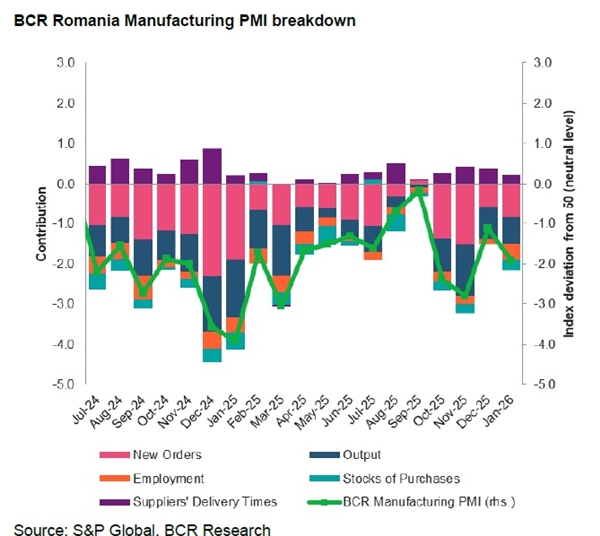

Romania’s manufacturing Purchasing Managers’ Index (PMI, chart) began 2026 at a low level, signalling continued weakness in the industrial sector, according to data released by BCR Erste Group.

The PMI index, compiled using S&P Global methodology, declined to 48.1 in January from 48.9 in December 2025, remaining below the 50 threshold that separates expansion from contraction. Erste Research reported on February 1 that the reading suggests the broadly expected industrial recovery is more likely to materialise in the second half of the year, assuming fiscal consolidation measures do not prolong economic stagnation.

The output sub-index showed a relative improvement in January, staying in negative territory but marking its strongest performance in four months. By contrast, the new orders index deteriorated compared with December and remained at a significantly negative level. Researchers said overall PMI weakness was amplified by worsening labour market conditions, with companies reporting insufficient manpower amid tighter income policies and an uncertain economic environment.

Reduced demand, partly linked to higher prices following tax increases, and labour shortages constraining output were cited as the main challenges faced by manufacturers. Erste Research said the pace of decline in new orders accelerated in January.

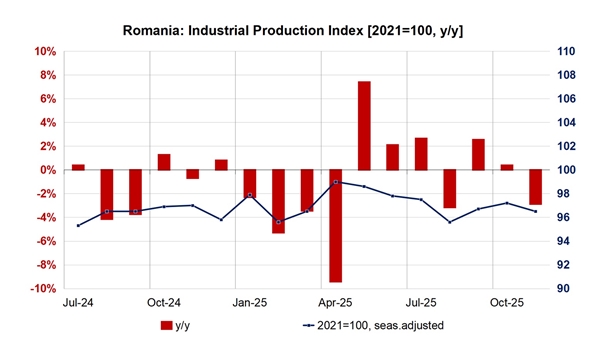

Over its short history (19 months), Romania's manufacturing PMI index does not show a clear correlation with industrial output trends (chart).

The National Commission for Strategy and Forecasting (CNP) expects industrial output to grow by 0.5% this year in both gross output and value-added terms, after three consecutive years of contraction.

In its December 2025 forecast, the commission projected output in the core manufacturing sector to increase by 0.6% in 2026, following a 0.8% decline last year. The improvement is expected to be driven mainly by slower declines, rather than outright growth, in sectors such as metallurgy, chemicals and automotive manufacturing.

Sectors forecast to maintain positive growth include food manufacturing, pharmaceuticals, metallic constructions, electronic and optical components, and industrial machinery and equipment. Crude oil refining is projected to shrink by 9.3% this year, after growing by 4.2% year on year in 2025, while mining and quarrying is expected to contract by a further 1.4%.

In line with the official forecast rather than the PMI signal, Erste Research said it remains cautiously optimistic about industrial performance in 2026. “Considering the external environment expectations, we should see an improvement in 2026, and we could end up with industrial production regaining some growth momentum,” the group said, pointing to stronger external demand supported by EU security investments and Germany’s fiscal stimulus for infrastructure and defence spending.

Unlock premium news, Start your free trial today.