Romania’s industrial output rebounds in May on low base

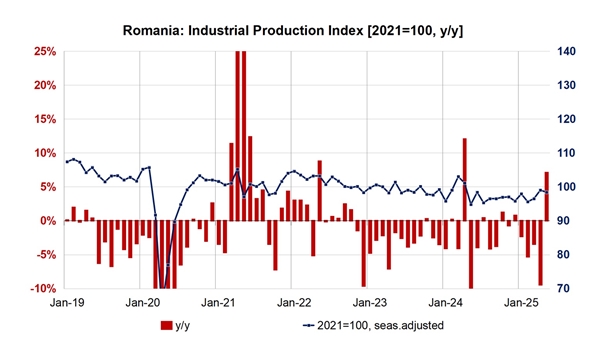

Romania’s industrial production (chart1, chart2) posted a sharp year-on-year increase of 7.1% in May, or 3.8% when adjusted for workdays, marking the most robust performance in three years, the National Institute of Statistics (INS) reported on July 15.

The May rebound follows a significant decline in April, when output dropped by 9.1% y/y, or 2.1% in workday-adjusted terms. The strong May figures offset part of the earlier losses, resulting in a combined year-on-year decline of 1.5% for the first two months of the second quarter. When adjusted for fewer working days in April and May compared to 2024, industrial output rose 0.8% y/y in the first two months of Q2.

Analysts at Erste Group noted that while the growth is encouraging, it was partially supported by base effects, given the depressed levels of industrial activity over the past two years.

Despite the recent improvement, Romania’s industrial output over the 12 months to May remains 7.9% below 2019 levels, or 6.9% when adjusted for workdays. The sector continues to struggle with a long-term slowdown that predates the pandemic crisis, amid persistent external challenges.

Erste Research estimates a slight decline in industrial production of 0.4% in 2025, an improvement from the 1.6% contraction in 2024 and the 3.0% drop in 2023.

The group noted a gradual improvement in local and international confidence indicators but postponed any meaningful recovery in manufacturing until next year.

Short-term signals remain cautiously optimistic. The BCR Romania Manufacturing Purchasing Managers’ Index (PMI) rose in June to a one-year high, although it remained below the 50-point threshold that separates contraction from expansion. New orders and output continued to weigh on the index, while employment, purchasing stocks, and delivery times supported the overall figure.

Manufacturing sentiment improved in June, driven by higher production expectations, according to the European Commission’s Economic Sentiment Indicator. Meanwhile, the manufacturing component of Germany’s Ifo Business Climate Index also showed marginal improvement, suggesting more optimism for the months ahead.

At the European level, the HCOB Eurozone Manufacturing PMI climbed in June to its highest level since August 2022, reflecting resilience amid global trade disruptions and geopolitical uncertainty.

Unlock premium news, Start your free trial today.