T-Technologies posts 83% jump in revenue and near-doubling of net profit for Q2 2025

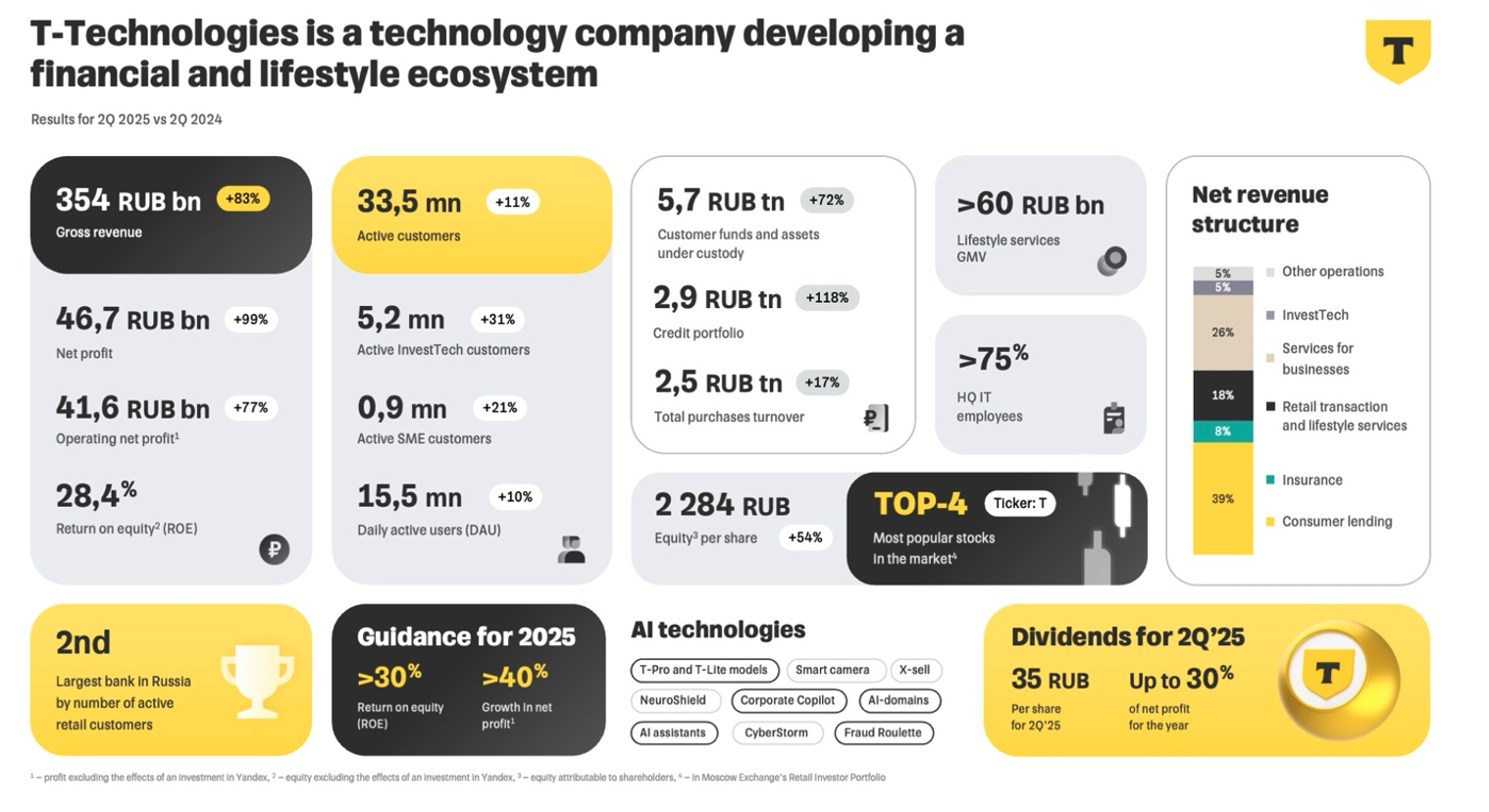

T-Technologies, formerly Tinkoff Bank and now the Russian technology group developing a financial and lifestyle ecosystem, reported a sharp increase in revenue and profits for the second quarter and first half of 2025, driven by strong customer growth, increased transactional activity and continued integration of artificial intelligence across its services, the company said in a press release on August 21.

In the three months ended on June 30, revenue rose by 83% year-on-year to RUB354bn ($3.82bn), while net profit nearly doubled to RUB46.7bn ($505mn). Operating net profit attributable to shareholders, excluding the effects of an investment in IPJSC Yandex, rose 77% to RUB41.6bn ($450mn), the company said in a statement published on August 21.

The number of customers increased by 16% over the same period to 51.4mn, including 44.1mn banking and lifestyle clients, 10.5mn investment customers and 1.6mn SME users. Active customer numbers rose 11% year-on-year to 33.5mn.

“We are now serving over 51mn customers, who, over the past six months, made purchases totalling over RUB4.7tn and entrusted us with RUB5.7tn,” said Stanislav Bliznyuk, President of T-Technologies. “While our shares in key markets... continue to grow, we still have significant potential to further grow and scale our business.”

The company said its AI initiatives, including the deployment of its proprietary large language model T-Pro 2.0, had led to measurable efficiency gains. Support response speed and quality improved by 10%, while automated processing of customer requests increased from 40% to 45%. The firm also cited higher user engagement from new AI-driven travel and investment assistants.

In 2Q 2025, net interest income rose 59% to RUB123.3bn, while net fee and commission income grew by 41% to RUB34bn. Total operating income rose 60% to RUB183bn. The company’s return on equity for the quarter stood at 28.4%.

The Board of Directors recommended a dividend of RUB35 per share based on second-quarter results. “Effective business growth and shareholder returns remain the focus of both the Board of Directors and management,” said Alexey Malinovsky, Chairman of the Board.

Operating expenses rose 47% year-on-year to RUB88bn, reflecting investments in IT, integration of Rosbank, and platform expansion. As of June 30, total assets had grown 85% year-on-year to RUB5.3tn, while total equity more than doubled to RUB726bn.

The Group confirmed its full-year 2025 guidance of at least 40% growth in operating net profit and a return on equity above 30%.

1. KEY OPERATING METRICS

|

T Ecosystem |

2Q |

2Q |

∆ |

1Q |

∆ |

|

Total customers, mn |

51.4 |

44.5 |

16% |

50.0 |

3% |

|

Active customers, mn |

33.5 |

30.3 |

11% |

33.0 |

2% |

|

Monthly active users (MAU), mn |

33.5 |

30.3 |

11% |

33.1 |

1% |

|

Daily active users (DAU), mn |

15.5 |

14.1 |

10% |

15.6 |

-1% |

|

Source: T-Technologies |

|||||

2. OVERVIEW OF FINANCIAL AND OPERATING PERFORMANCE

|

RUB bn |

2Q |

2Q |

∆ |

1Q |

∆ |

1H |

1H |

∆ |

|

Interest income |

263.4 |

132.6 |

99% |

256.0 |

3% |

519.5 |

246.1 |

2.1x |

|

Interest expense |

-136.1 |

-52.5 |

2.6x |

-137.3 |

-1% |

-273.4 |

-90.8 |

3.0x |

|

Net interest income |

123.3 |

77.7 |

59% |

114.8 |

7% |

238.1 |

150.9 |

58% |

|

Net interest income after provisions |

77.2 |

54.8 |

41% |

81.1 |

-5% |

158.3 |

106.8 |

48% |

|

Fee and commission Income |

56.0 |

42.2 |

33% |

51.0 |

10% |

106.9 |

76.4 |

40% |

|

Fee and commission expense |

-22.0 |

-18.1 |

21% |

-20.9 |

5% |

-42.9 |

-34.0 |

26% |

|

Net fee and commission income |

34.0 |

24.0 |

41% |

30.0 |

13% |

64.0 |

42.4 |

51% |

|

Total operating expenses |

-87.9 |

-59.8 |

47% |

-80.6 |

9% |

-168.5 |

-114.8 |

47% |

|

Profit before tax |

62.0 |

29.6 |

2.1x |

44.7 |

39% |

106.7 |

57.9 |

84% |

|

Net profit |

46.7 |

23.5 |

99% |

33.5 |

40% |

80.2 |

45.7 |

75% |

|

Net profit attributable to shareholders |

42.5 |

23.4 |

81% |

33.3 |

28% |

75.7 |

45.7 |

66% |

|

Operating net profit* |

41.6 |

23.4 |

77% |

33.3 |

25% |

74.9 |

45.7 |

64% |

|

Source: T-Technologies |

||||||||

* Attributable to shareholders, excluding the effects of the investment in IPJSC Yandex

|

Ratios |

2Q |

2Q |

∆ |

1Q |

∆ |

1H |

1H |

∆ |

|

Return on equity |

28.9% |

32.7% |

-3.8 p.p. |

24.6% |

4.3 p.p. |

26.5% |

32.0% |

-5.5 p.p. |

|

Return on equity attributable to shareholders |

28.8% |

32.6% |

-3.8 p.p. |

24.5% |

4.3 p.p. |

26.9% |

32.0% |

-5.1 p.p. |

|

Operating return on equity (ROE)* |

28.4% |

32.6% |

-4.2 p.p. |

24.5% |

3.9 p.p. |

26.6% |

32.0% |

-5.4 p.p. |

|

Net interest margin |

10.8% |

12.5% |

-1.7 p.p. |

10.3% |

0.5 p.p. |

10.4% |

12.9% |

-2.5 p.p. |

|

Cost of risk |

6.7% |

7.5% |

-0.8 p.p. |

5.2% |

1.5 p.p. |

5.9% |

7.5% |

-1.6 p.p. |

|

Source: T-Technologies |

||||||||

* Attributable to shareholders, excluding the effects of the investment in IPJSC Yandex

|

RUB bn |

30 June 2025 |

31 March 2025 |

∆ |

31 December 2024 |

∆ |

30 June 2024 |

∆ |

|

Total assets |

5,326 |

4,731 |

13% |

5,118 |

4% |

2,884 |

85% |

|

Net loans and advances to customers |

2,774 |

2,533 |

10% |

2,537 |

9% |

1,190 |

2.3x |

|

Cash and cash equivalents |

975 |

1,001 |

-3% |

1,427 |

-32% |

924 |

6% |

|

Total liabilities |

4,601 |

4,164 |

10% |

4,597 |

0% |

2,588 |

78% |

|

Customer accounts |

4,000 |

3,711 |

8% |

4,010 |

0% |

2,292 |

75% |

|

Total equity |

726 |

568 |

28% |

521 |

39% |

296 |

2.5x |

|

Total equity attributable to shareholders |

613 |

566 |

8% |

520 |

18.0% |

296 |

2.1x |

|

Total equity attributable to shareholders, excluding the effects of the investment in Yandex |

606 |

566 |

7% |

520 |

17% |

296 |

2.1x |

|

Source: T-Technologies |

|||||||

|

Ratios |

30 June 2025 |

31 March 2025 |

∆ |

31 December 2024 |

∆ |

30 June 2024 |

∆ |

|

Share of NPLs |

6.5% |

6.6% |

-0.1 p.p. |

5.8% |

0.7 p.p. |

9.3% |

-2.8 p.p. |

|

Tier 1 capital ratio |

14.0% |

13.1% |

0.9 p.p. |

12.8% |

1.2 p.p. |

14.3% |

-0.3 p.p. |

|

Total capital ratio |

14.0% |

13.1% |

0.9 p.p. |

12.8% |

1.2 p.p. |

14.3% |

-0.3 p.p. |

|

Source: T-Technologies |

|||||||

|

RUB bn |

2Q |

2Q |

∆ |

1Q |

∆ |

1H |

1H |

∆ |

|

Net profit |

46.7 |

23.5 |

99% |

33.5 |

40% |

80.2 |

45.7 |

75% |

|

Non-controlling interest |

4.3 |

0.0 |

-/- |

0.2 |

-/- |

4.5 |

0.0 |

-/- |

|

Net profit attributable to shareholders |

42.5 |

23.4 |

81% |

33.3 |

28% |

75.7 |

45.7 |

66% |

|

Income from the revaluation of Yandex, net of tax |

2.1 |

-/- |

-/- |

-/- |

-/- |

2.1 |

-/- |

-/- |

|

Interest expense on borrowings, net of tax |

-1.3 |

-/- |

-/- |

-/- |

-/- |

-1.3 |

-/- |

-/- |

|

Operating net profit* |

41.6 |

23.4 |

77% |

33.3 |

25% |

74.9 |

45.7 |

64% |

|

Source: T-Technologies |

||||||||

* Attributable to shareholders, excluding the effects of the investment in IPJSC Yandex

Unlock premium news, Start your free trial today.