Istanbul-listed Sasa sells €415mn five-year convertible eurobond at 4.75% coupon

Sasa Polyester (SASA), a Borsa Istanbul-listed textile materials producer, has sold €415mn of a convertible eurobond (XS3243825851) due 2031 at a coupon rate and yield-to-investor of 4.75% (priced at 100), the company said on January 8.

BNP Paribas, HSBC and JPMorgan acted as intermediaries in the deal.

In October, Fitch Ratings downgraded Sasa’s rating to CCC from B-.

17% stake to be converted

The paper will pay quarterly coupons. It carries a reference share price of €0.0473 and an initial conversion price of €0.0568.

The conversion price has been set at a premium of 20% above the reference price and an EUR/TRY spot rate of 50.3224 was used. It suggests a share price of Turkish lira (TRY) 2.38.

The initial conversion ratio stood at 1.76mn shares for a nominal €0.1mn worth of papers. Papers worth €415mn equals 7.3bn shares, representing a 16.7% stake in the company’s TRY 43.8bn of paid-in capital.

Bondholders may exercise their conversion right starting from July 15, 2026.

Shareholders active in trading

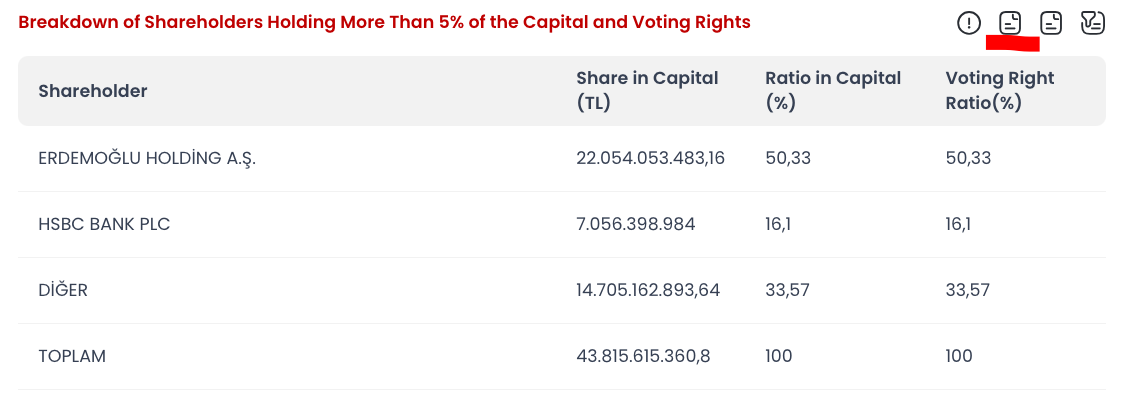

As of January 10, Erdemoglu Holding held a 50.33% stake in Sasa while HSBC Bank plc owned a 16.1% stake (7.06bn shares), representing the convertible papers.

Table: Sasa shareholding structure.

A total 31.1% is listed on the Borsa Istanbul.

Erdemoglu Holding and its owners are rather active in trading Sasa shares. They regularly execute wholesale share sales in addition to direct transactions on the company’s trading board.

Share price falls further

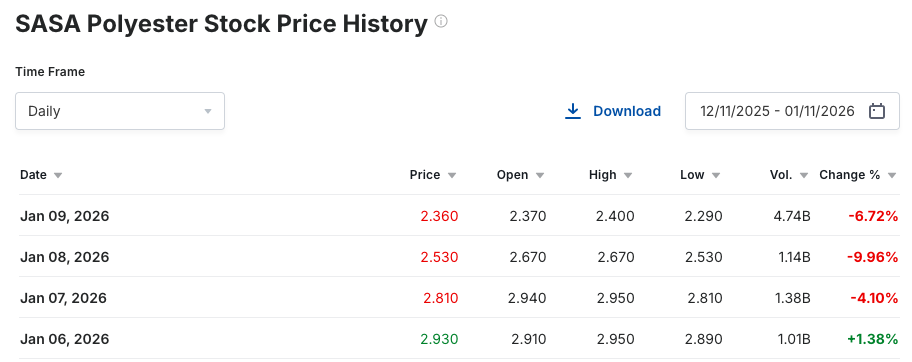

On news of the fresh convertible papers, the company’s share price dipped further.

During 2022 and 2023, the company’s share price saw the TRY 8s (adjusted to consecutive stock splits) and Sasa was the largest company on the Borsa Istanbul.

Thanks to the interesting performance of Sasa shares, the owners of Erdemoglu Holding, namely brothers Ibrahim Erdemoglu and Ali Erdemoglu, are currently among Turkey’s richest billionaires, according to Forbes.

After the company announced on January 7 that it had launched a bookbuilding for a fresh convertible eurobond, the share price nosedived from TRY 2.95 to TRY 2.36 at market close on January 9.

Table: Sasa share price.

Second convertible paper

In June 2021, Sasa sold €200mn of the five-year convertible eurobonds (XS2357838601) in question at a coupon rate of 3.25%.

Between January 2022 and September 2023, all papers were converted to shares. They represented around 2.5% of the company.

The latest and second paper also stands as the only convertible eurobond sold by a Turkish company.

Unlock premium news, Start your free trial today.